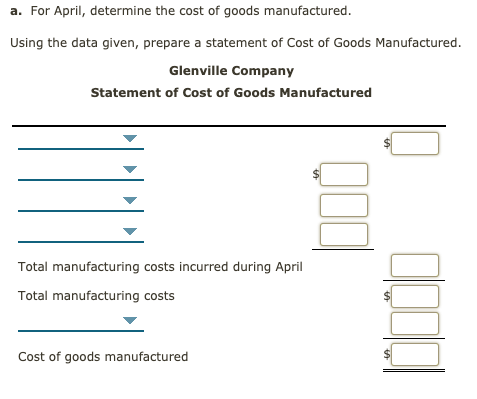

Question: DROP DOWN OPTIONS FOR (A): First drop-down options: Direct labor, Factory overhead, Finished goods inventory April 10, Work in progress inventory April 1 Second drop-down

DROP DOWN OPTIONS FOR (A):

First drop-down options: Direct labor, Factory overhead, Finished goods inventory April 10, Work in progress inventory April 1

Second drop-down options: Cost of direct materials used in production, Cost of goods manufactured, Work in progress inventory April 1, work in progress inventory April 30

Third drop-down options: Direct labor, Finished goods inventory April 1, Work in progress inventory April 1, Work in progress inventory April 30

Fourth drop-down options: Cost of finished goods available for sale, Factory overhead, Finished goods inventory April 30, Work in progress inventory April 1

Fifth drop-down options: Less direct labor, Less factory overhead, Less finished goods inventory April 30, Less work in progress inventory April 30.

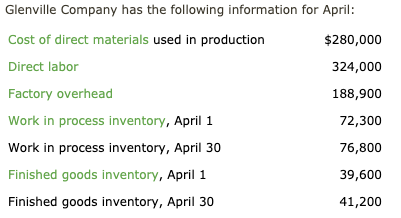

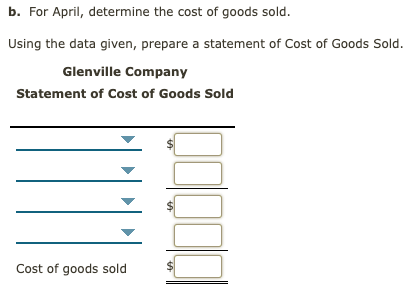

Glenville Company has the following information for April: Cost of direct materials used in production $280,000 Direct labor 324,000 Factory overhead 188,900 Work in process inventory, April 1 72,300 Work in process inventory, April 30 76,800 Finished goods inventory, April 1 39,600 Finished goods inventory, April 30 41,200 a. For April, determine the cost of goods manufactured. Using the data given, prepare a statement of Cost of Goods Manufactured. Glenville Company Statement of Cost of Goods Manufactured Total manufacturing costs incurred during April Total manufacturing costs Cost of goods manufactured b. For April, determine the cost of goods sold. Using the data given, prepare a statement of Cost of Goods Sold. Glenville Company Statement of Cost of Goods Sold Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts