Question: DROP DOWN OPTIONS: PARTS D & E PLEASE! On January 1, 2020, Jet Air Inc. contracted with Systems Plus Inc. to manufacture heavy equipment. Jet

DROP DOWN OPTIONS:

PARTS D & E PLEASE!

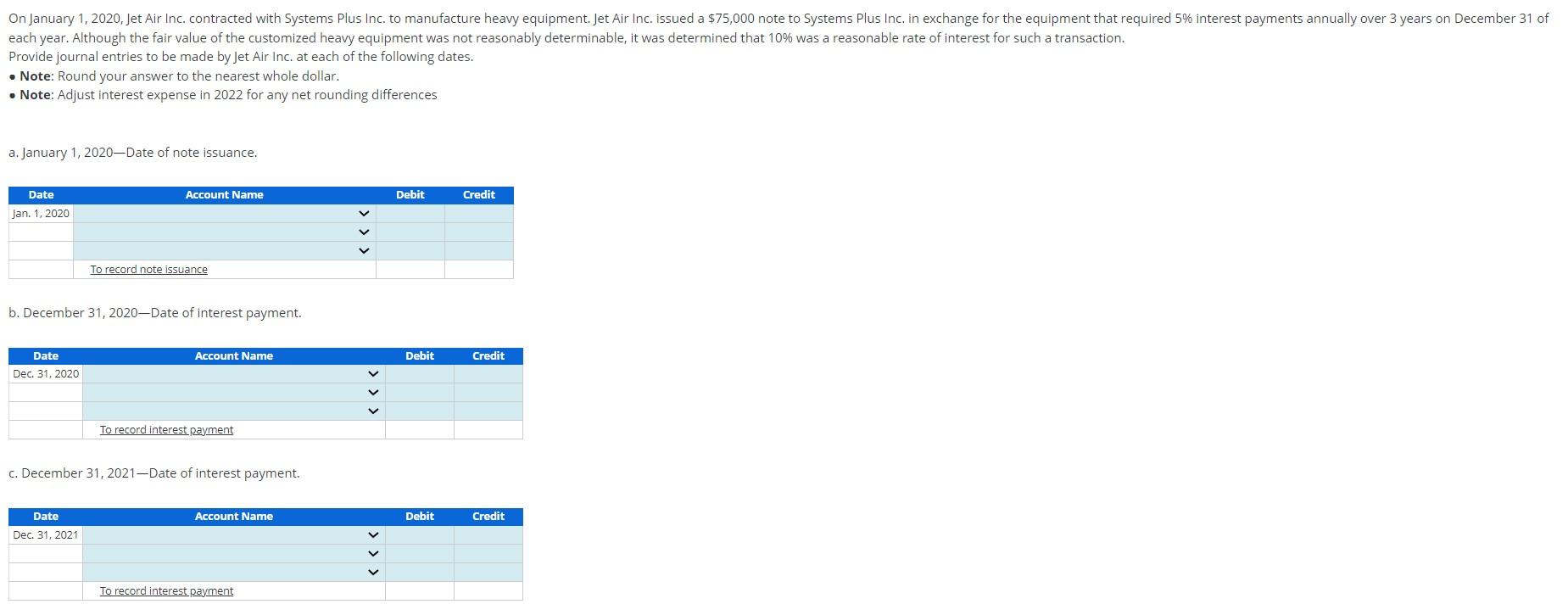

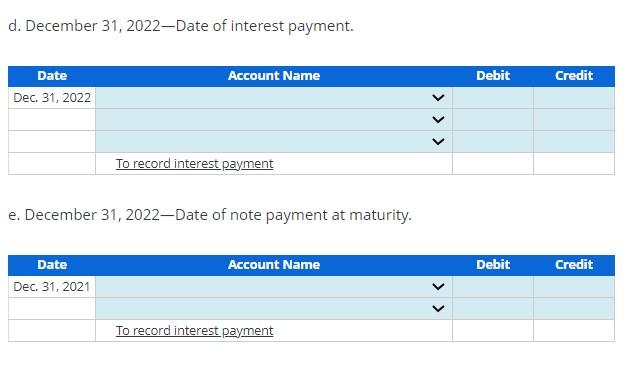

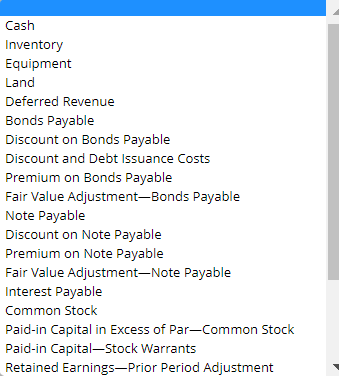

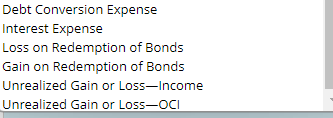

On January 1, 2020, Jet Air Inc. contracted with Systems Plus Inc. to manufacture heavy equipment. Jet Air Inc. issued a $75,000 note to Systems Plus Inc. in exchange for the equipment that required 5% interest payments annually over 3 years on December 31 of each year. Although the fair value of the customized heavy equipment was not reasonably determinable, it was determined that 10% was a reasonable rate of interest for such a transaction. Provide journal entries to be made by Jet Air Inc. at each of the following dates. Note: Round your answer to the nearest whole dollar. Note: Adjust interest expense in 2022 for any net rounding differences a. January 1, 2020-Date of note issuance. Date Jan. 1, 2020 Date Dec. 31, 2020 Account Name b. December 31, 2020-Date of interest payment. To record note issuance Date Dec. 31, 2021 Account Name To record interest payment c. December 31, 2021-Date of interest payment. Account Name To record interest payment Debit Debit Debit Credit Credit Credit d. December 31, 2022-Date of interest payment. Date Dec. 31, 2022 Account Name Date Dec. 31, 2021 To record interest payment e. December 31, 2022-Date of note payment at maturity. Account Name To record interest payment Debit Debit Credit Credit Cash Inventory Equipment Land Deferred Revenue Bonds Payable Discount on Bonds Payable Discount and Debt Issuance Costs Premium on Bonds Payable Fair Value Adjustment-Bonds Payable Note Payable Discount on Note Payable Premium on Note Payable Fair Value Adjustment-Note Payable Interest Payable Common Stock Paid-in Capital in Excess of Par-Common Stock Paid-in Capital-Stock Warrants Retained Earnings-Prior Period Adjustment Debt Conversion Expense Interest Expense Loss on Redemption of Bonds Gain on Redemption of Bonds Unrealized Gain or Loss-Income Unrealized Gain or Loss-OCI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts