Question: DROP DOWN OPTIONS: Recording Bonds Issued at a Premium- Effective Interest Yale Corporation issued to Zap Corporation $60,000, 8% (cash interest payable semiannually on June

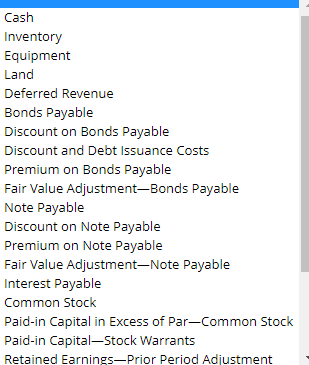

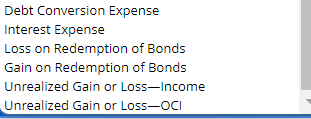

DROP DOWN OPTIONS:

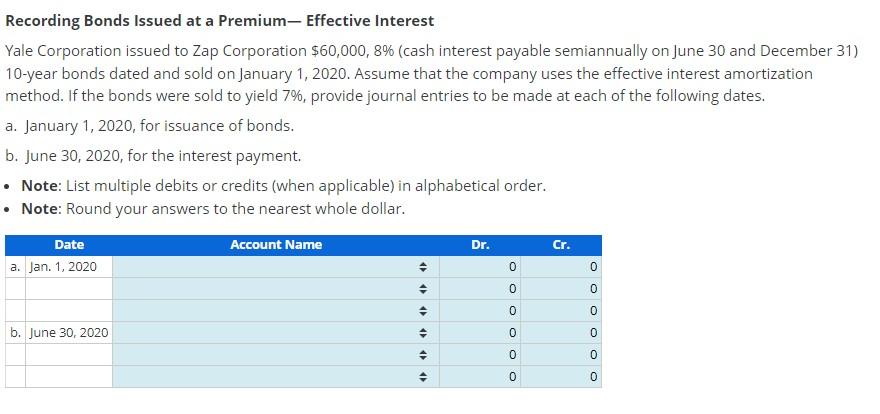

Recording Bonds Issued at a Premium- Effective Interest Yale Corporation issued to Zap Corporation $60,000, 8% (cash interest payable semiannually on June 30 and December 31) 10-year bonds dated and sold on January 1, 2020. Assume that the company uses the effective interest amortization method. If the bonds were sold to yield 7%, provide journal entries to be made at each of the following dates. a. January 1, 2020, for issuance of bonds. b. June 30, 2020, for the interest payment. Note: List multiple debits or credits (when applicable) in alphabetical order. Note: Round your answers to the nearest whole dollar. Date a. Jan. 1, 2020. b. June 30, 2020 Account Name 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts