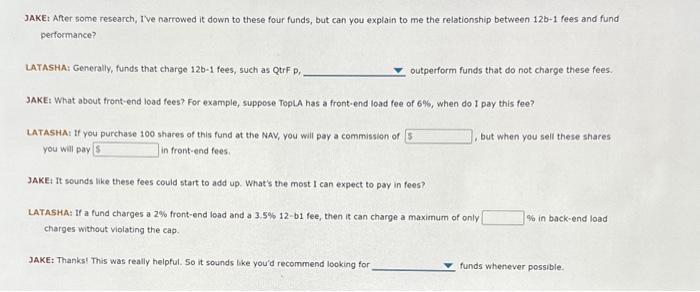

Question: Drop Downs: 1. do not necessarily, always 2. front-end load, low load, no load, back end load Understanding the Costs Involved in Mutual Fund Investments

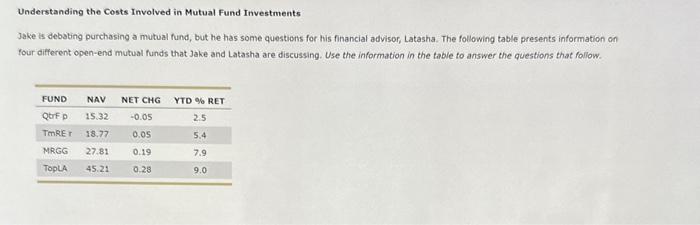

Understanding the Costs Involved in Mutual Fund Investments Jake is debating purchasing a mutual fund, but he has some questions for his financial advisor, Latasha. The following tabie presents information on four different open-end mutual funds that Jake and Latasha are discussing. Use the information in the table to answer the questions that foliow. JAkE: After some research, IVe narrowed it down to these four funds, but can you explain to me the relationship between 12b - 1 fees and fund pertormance? LATASHA: Generally, funds that charge 12b1 fees, such as QtrF p, outperform funds that do not charge these fees. JAKEt What about front-end load fees? For example, suppose ToplA has a front-end load fee of 6%, when do I pay this fee? LATASHA: If you purchase 100 shares of this fund at the NAV, you will pay a commission of but when you sell these shares you will pay in front-end fees. JAKE, It sounds like these fees could start to add up. What's the most I can expect to pay in fees? LATASHA: If a fund charges a 2% front-end load and a 3.5%12b1 fee, then it can charge a maximum of only % in back-end laad charges without violating the cap. JAKE: Thanks! This was really helpful. 50 it sounds like you'd recommend looking for funds whenever possible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts