Question: DROP DOWNS. 1 PLAN APLHA OR PLAN BETA 2 POSITIVE OR NEGATIVE 3 GREATER THAN OR LESS THAN 4. GREATER THAN THE ORIGINAL COST, EQUAL

DROP DOWNS.

1 PLAN APLHA OR PLAN BETA

2 POSITIVE OR NEGATIVE

3 GREATER THAN OR LESS THAN

4. GREATER THAN THE ORIGINAL COST, EQUAL TO ZERO, LESS THAN THE SUM OF CASH FLOW

5. GREATER THAN OR LESS THAN

6. GREATER THAN OR LESS THAN

7 ARE OR ARE NOT

9 POSITIVE OR NEGATIVE

10 GREATER THAN OR LESS THAN

11 POSITIVE OR NEGATIVE

12 GREATER THAN OR LESS THAN

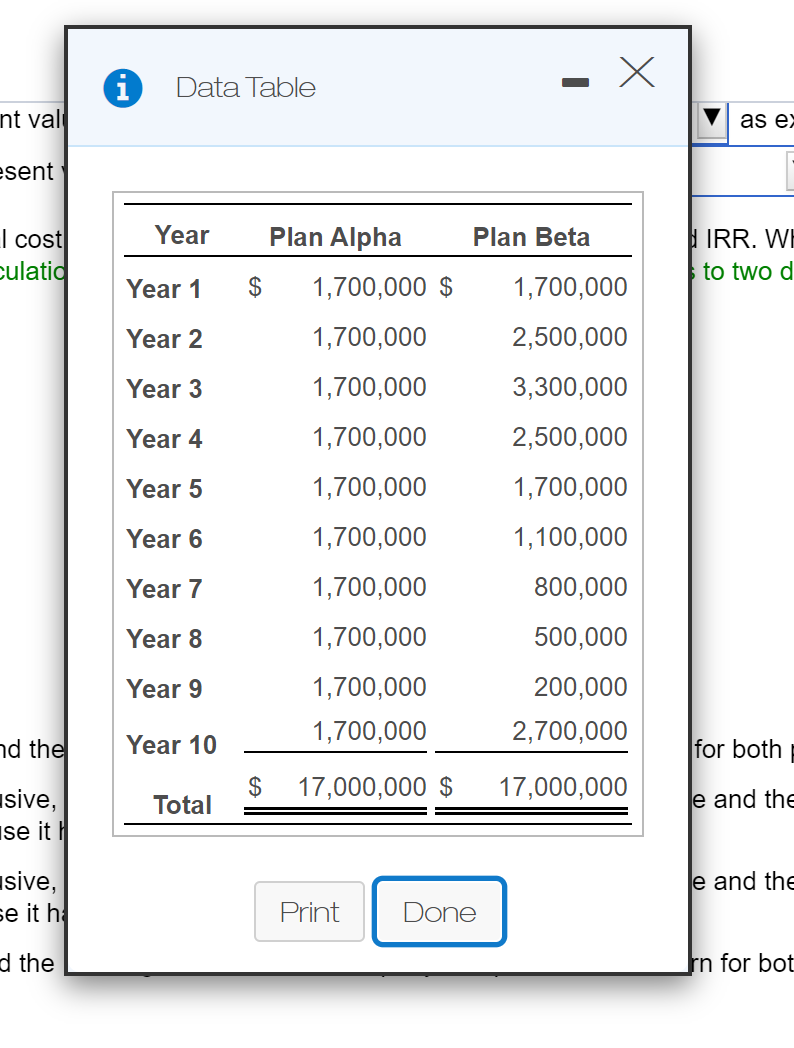

i Data Table nt val as e- esent Year Plan Alpha Plan Beta I cost culatia JIRR. WE to two d Year 1 $ 1,700,000 1,700,000 $ 1,700,000 Year 2 2,500,000 Year 3 1,700,000 3,300,000 Year 4 1,700,000 2,500,000 Year 5 1,700,000 1,700,000 Year 6 1,100,000 Year 7 1,700,000 1,700,000 1,700,000 800,000 500,000 Year 8 Year 9 1,700,000 1,700,000 200,000 2,700,000 nd the Year 10 for both $ 17,000,000 $ 17,000,000 usive, ise it Total e and the le and the usive, se it hl Print Done d the rn for bot Langley Company is considering two capital investments. Both investments have an initial cost of $9,000.000 and total net cash inflows of $17,000,000 over 10 years. Langley requires a 16% rate of return on this type of investment Expected net cash inflows are as follows: (Click the icon to view the expected net cash inflows.) Read the requirements Requirement 1. Use Excel to compute the NPV and IRR of the two plans, which plan, if any, should the company pursue? (Use parentheses or a minus sign for a negative NPV. Round the NPV calculations to the nearest whole dollar and the IRR calculations to two decimal places, X.XX%.) The NPV (net present value) of Plan Alpha is The NPV (net present value) of Plan Beta is The IRR (internal rate of return) of Plan Alpha is The IRR (internal rate of return) of Plan Beta is Which plan, if any, should the company pursue? Based on the results above, the company should pursue becouse the NPV is and the IRR IS the company's required rate of return. Requirement 2. Explain the relationship between NPV and IRR. Based on this relationship and the company's required rate of return, are your answers as expected in Requirement 1? Why or why not? Thus, if an investment's net present value is positive, the internal rate of return is The internal rate of return is the interest rate that makes the net present value of an investment the required rate of return and if the net present value is negative, the internal rate of return is the required rate of return. Based on this relationship and the company's required rate of return, are your answers as expected in Requirement 1? Why or why not? V as expected. For Plan Alpha, the net present value is v and the internal Based on the relationship described above, the internal rate of return and net present value calculated in Requirement 1 for the two plans rate of return is the required rate of return. For Plan Beta, the net present value is and the internal rate of return is the required rate of return. Langley Company is considering two capital investments. Both investments have an initial cost of $9,000,000 and total net cash inflows of $17,000,000 over 10 years. Langley requires a 16% rate of return on this type of inve Expected net cash inflows are as follows: (Click the icon to view the expected net cash inflows.) Read the requirements. Based on the relationship described above, the internal rate of return and net present value calculated in Requirement 1 for the two plans rate of return is V the required rate of return. For Plan Beta, the net present value is and the internal rate of return is Vand the int as expected. For Plan Alpha, the net present value is the required rate of retum. Requirement 3. After further negotiating, the company can now invest with an initial cost of $7,800,000 for both plans. Recalculate the NPV and IRR. Which plan, if any, should the company pursue? (Use Excel to determine answers. Use parentheses or a minus sign for a negative NPV. Round the NPV calculations to the nearest whole dollar and the IRR calculations to two decimal places, X.XX%) The NPV (net present value) of Plan Alpha is $ The NPV (net present value) of Plan Beta is $ The IRR (internal rate of retum) of Plan Alpha is The IRR (internal rate of retum) of Plan Beta is Which plan, if any, should the company pursue? . The company should not pursue either plan because the NPV is negative and the IRR is less than the company's required rate of return for both plans, OB. If the company has sufficient resources and the plans are not mutually exclusive, it should pursue both plans because the NPV is positive and the IRR is greater than the company's required rate of return for both plar the company must choose only one plan, It should pursue Plan Alpha because it has the lower NPV and IRR. O c. If the company has sufficient resources and the plans are not mutually exclusive, it should pursue both plans because the NPV is positive and the IRR is greater than the company's required rate of return for both plar the company must choose only one plan, it should pursue Plan Beta because it has the higher NPV and IRR. OD. The company should not pursue either plan because the NPV is positive and the IRR is greater than the company required rate of return for both plans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts