Question: drop downs 1.added to/deducted from 2. increasing/reducing 3.appreciates/depriciates 4.equal or greater/ less 5.less/more Which is better: to rent or to buy? The decision of whether

drop downs

1.added to/deducted from

2. increasing/reducing

3.appreciates/depriciates

4.equal or greater/ less

5.less/more

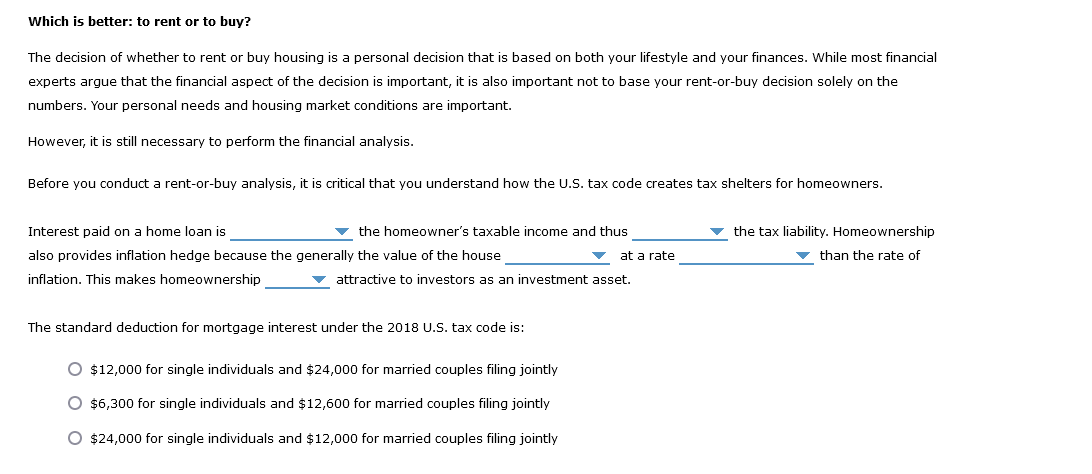

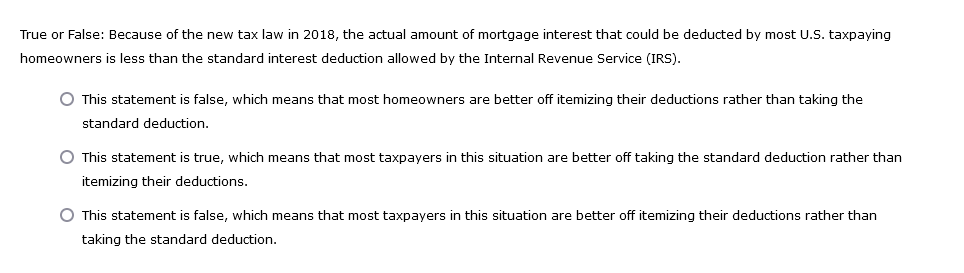

Which is better: to rent or to buy? The decision of whether to rent or buy housing is a personal decision that is based on both your lifestyle and your finances. While most financial experts argue that the financial aspect of the decision is important, it is also important not to base your rent-or-buy decision solely on the numbers. Your personal needs and housing market conditions are important. However, it is still necessary to perform the financial analysis. Before you conduct a rent-or-buy analysis, it is critical that you understand how the U.S. tax code creates tax shelters for homeowners. Interest paid on a home loan is the homeowner's taxable income and thus the tax liability. Homeownership also provides inflation hedge because the generally the value of the house thate rate the inflation. This makes homeownership attractive to investors as an investment asset. The standard deduction for mortgage interest under the 2018 U.S. tax code is: $12,000 for single individuals and $24,000 for married couples filing jointly $6,300 for single individuals and $12,600 for married couples filing jointly $24,000 for single individuals and $12,000 for married couples filing jointly True or False: Because of the new tax law in 2018, the actual amount of mortgage interest that could be deducted by most U.S. taxpaying homeowners is less than the standard interest deduction allowed by the Internal Revenue Service (IRS). This statement is false, which means that most homeowners are better off itemizing their deductions rather than taking the standard deduction. This statement is true, which means that most taxpayers in this situation are better off taking the standard deduction rather than itemizing their deductions. This statement is false, which means that most taxpayers in this situation are better off itemizing their deductions rather than taking the standard deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts