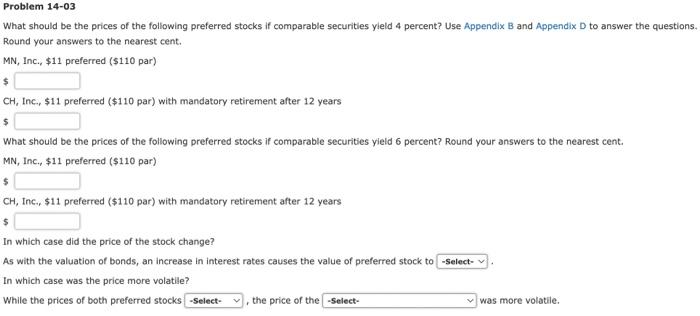

Question: drop downs: first drop down- fall or rise second drop down- declined or increased third drop down- perpetual preferred stock or stock with mandatory retirement

Problem 14-03 What should be the prices of the following preferred stocks if comparable securities yleld 4 percent? Use Appendix B and Appendix D to answer the questions, Round your answers to the nearest cent. MN, Inc., $11 preferred ($110 par) CH, Inc. $11 preferred ($110 par) with mandatory retirement after 12 years What should be the prices of the following preferred stocks if comparable securities yield 6 percent? Round your answers to the nearest cent. MN, Inc., $11 preferred ($110 par) $ CH, Inc., $11 preferred ($110 par) with mandatory retirement after 12 years $ In which case did the price of the stock change? As with the valuation of bonds, an increase in interest rates causes the value of preferred stock to -Select- In which case was the price more volatile? While the prices of both preferred stocks -Select- the price of the -Select- was more volatile

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts