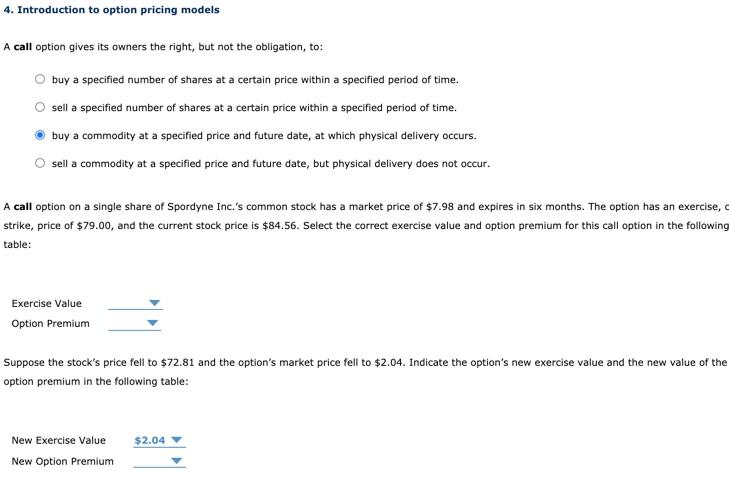

Question: Drop downs for the first two drop downs- $5.56, $7.98, $0.00, $2.42 Drop Downs for the last two - $5.56, $2.42, $0.00, $2.04 4. Introduction

Drop downs for the first two drop downs- $5.56, $7.98, $0.00, $2.42

Drop Downs for the last two - $5.56, $2.42, $0.00, $2.04

4. Introduction to option pricing models A call option gives its owners the right, but not the obligation, to: buy a specified number of shares at a certain price within a specified period of time. sell a specified number of shares at a certain price within a specified period of time. buy a commodity at a specified price and future date, at which physical delivery occurs. sell a commodity at a specified price and future date, but physical delivery does not occur. A call option on a single share of Spordyne Inc.'s common stock has a market price of $7.98 and expires in six months. The option has an exercise, strike, price of $79.00, and the current stock price is $84.56. Select the correct exercise value and option premium for this call option in the following table: Exercise Value Option Premium Suppose the stock's price fell to $72.81 and the option's market price fell to $2.04. Indicate the option's new exercise value and the new value of the option premium in the following table: New Exercise Value $2.04 New Option Premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts