Question: Dropbox Discussions E QuizzesGrades More Tools Chapter 8&9 HW Part 2 Quiz y Bever: Attempt 3 Question 4 (2 points) Summer Tyme, Inc., is considering

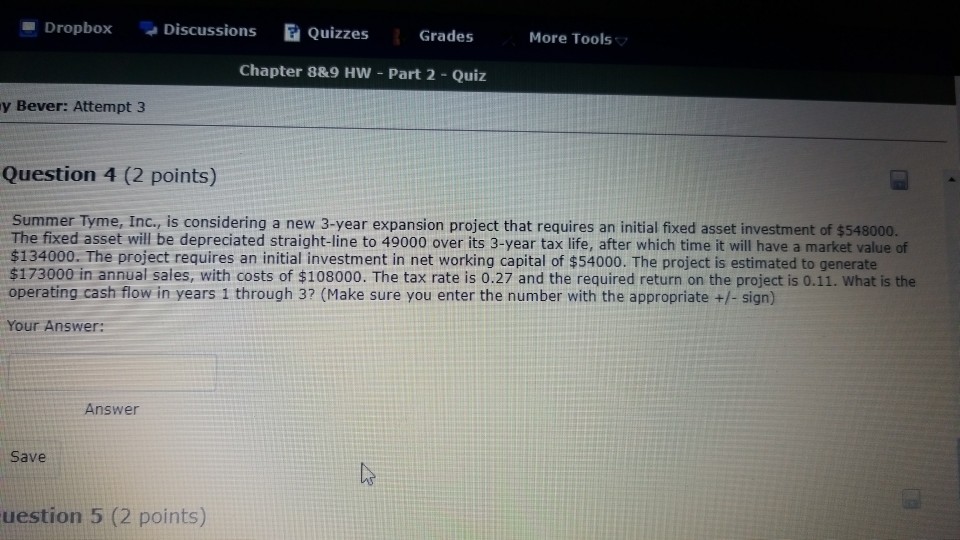

Dropbox Discussions E QuizzesGrades More Tools Chapter 8&9 HW Part 2 Quiz y Bever: Attempt 3 Question 4 (2 points) Summer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $548000. The fixed asset will be depreciated straight-line to 49000 over its 3-year tax life, after which time it will have a market value of $134000. The project requires an initial investment in net working capital of $54000. The project is estimated to generate $173000 in annual sales, with costs of $108000. The tax rate is 0.27 and the required return on the project is 0.11. What is the operating cash flow in years 1 through 3? (Make sure you enter the number with the appropriate +/- sign) Your Answer: Answer Save uestion 5 (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts