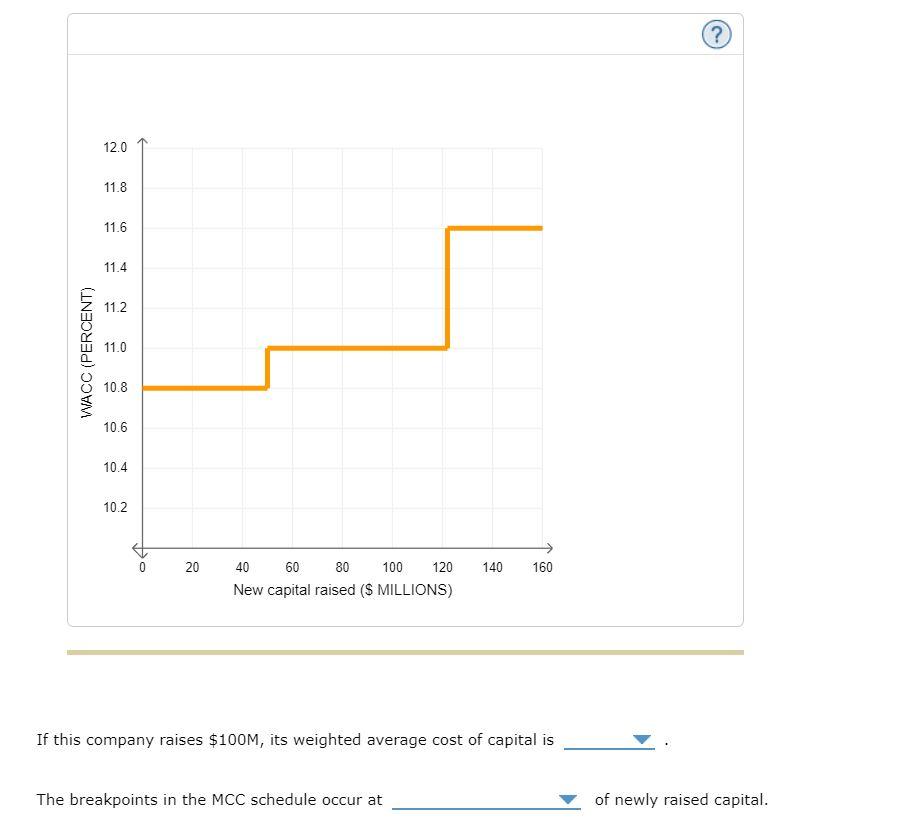

Question: DROPDOWN OPTIONS: 1) 16.3% / 11.6% / 11% / 10.8% 2) 11.0% and 11.6% OR $50M and $122M 8. Marginal cost of capital (MCC) schedule

DROPDOWN OPTIONS:

1) 16.3% / 11.6% / 11% / 10.8%

2) 11.0% and 11.6% OR $50M and $122M

8. Marginal cost of capital (MCC) schedule As a company raises more and more funds, the cost of those funds begins to rise. As this occurs, the weighted cost of each new dollar rises. This is called the marginal cost of capital. A graph that shows how the weighted average cost of capital changes as more new capital is raised by the firm is called the MCC (marginal cost of capital) schedule. Use the MCC schedule to complete the sentences that follow. ? 12.0 11.8 11.6 11.4 11.2 WACC (PERCENT) 11.0 10.8 10.6 10.4 10.2 20 140 160 40 60 80 100 120 New capital raised ($ MILLIONS) If this company raises $100M, its weighted average cost of capital is The breakpoints in the MCC schedule occur at of newly raised capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts