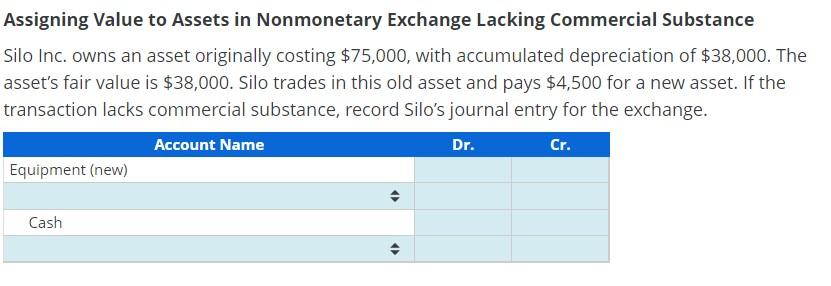

Question: DROPDOWN OPTIONS: Assigning Value to Assets in Nonmonetary Exchange Lacking Commercial Substance Silo Inc. owns an asset originally costing $75,000, with accumulated depreciation of $38,000.

DROPDOWN OPTIONS:

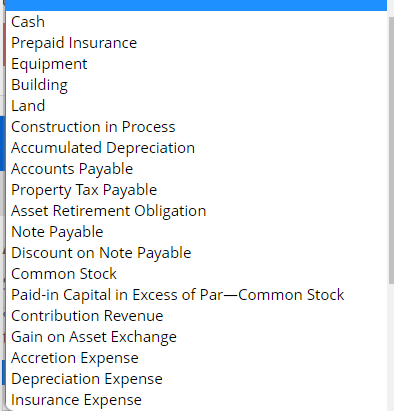

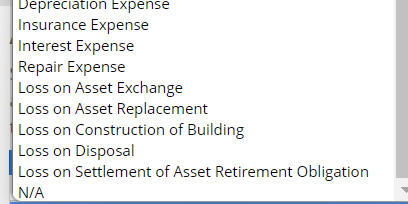

Assigning Value to Assets in Nonmonetary Exchange Lacking Commercial Substance Silo Inc. owns an asset originally costing $75,000, with accumulated depreciation of $38,000. The asset's fair value is $38,000. Silo trades in this old asset and pays $4,500 for a new asset. If the transaction lacks commercial substance, record Silo's journal entry for the exchange. Account Name Dr. Cr. Equipment (new) Cash O Cash Prepaid Insurance Equipment Building Land Construction in Process Accumulated Depreciation Accounts Payable Property Tax Payable Asset Retirement Obligation Note Payable Discount on Note Payable Common Stock Paid-in Capital in Excess of Par-Common Stock Contribution Revenue Gain on Asset Exchange Accretion Expense Depreciation Expense Insurance Expense Depreciation Expense Insurance Expense Interest Expense Repair Expense Loss on Asset Exchange Loss on Asset Replacement Loss on Construction of Building Loss on Disposal Loss on Settlement of Asset Retirement Obligation N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts