Question: Drum + FINA2203 Homework 4 Saved Help Save & Exit Submit le Study tools My courses Check my work EST $219 6 Calculate the NPV

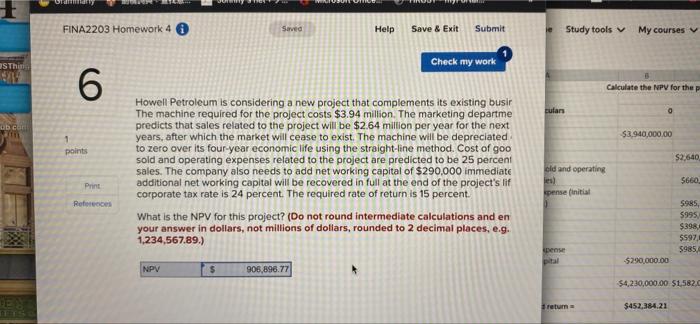

Drum + FINA2203 Homework 4 Saved Help Save & Exit Submit le Study tools My courses Check my work EST $219 6 Calculate the NPV for the p pulan o uab.cat 3 $3.940,000.00 1 points $2640 Howell Petroleum is considering a new project that complements its existing busir The machine required for the project costs $3.94 million. The marketing departme predicts that sales related to the project will be $2.64 million per year for the next years, after which the market will cease to exist. The machine will be depreciated to zero over its four-year economic life using the straight-line method. Cost of goo sold and operating expenses related to the project are predicted to be 25 percent sales. The company also needs to add net working capital of $290,000 immediate additional networking capital will be recovered in full at the end of the project's lif corporate tax rate is 24 percent. The required rate of return is 15 percent. What is the NPV for this project? (Do not round intermediate calculations and en your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g. 1,234,567.89.) old and operating les spense (Initial Print 5660 References SARS 5995 $398 5597 5985 pense $290,000.00 NPV 905,896.77 54,230,000.00 $1,582 ES retum $452,384,21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts