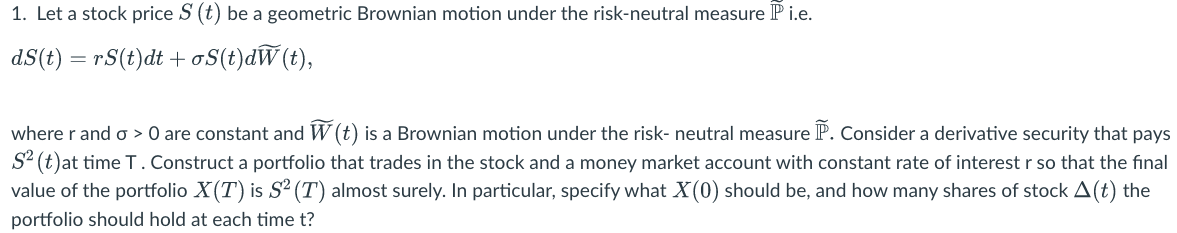

Question: dS(t)=rS(t)dt+S(t)dW(t) where r and >0 are constant and W(t) is a Brownian motion under the risk- neutral measure P. Consider a derivative security that pays

dS(t)=rS(t)dt+S(t)dW(t) where r and >0 are constant and W(t) is a Brownian motion under the risk- neutral measure P. Consider a derivative security that pays S2(t) at time T. Construct a portfolio that trades in the stock and a money market account with constant rate of interest r so that the final value of the portfolio X(T) is S2(T) almost surely. In particular, specify what X(0) should be, and how many shares of stock (t) the portfolio should hold at each time t

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock