Question: Due: 07 April 2022 MAP4C Homework assignment Read the case studies below Aziza works full time. Her husband Hassan is a student with a part-time

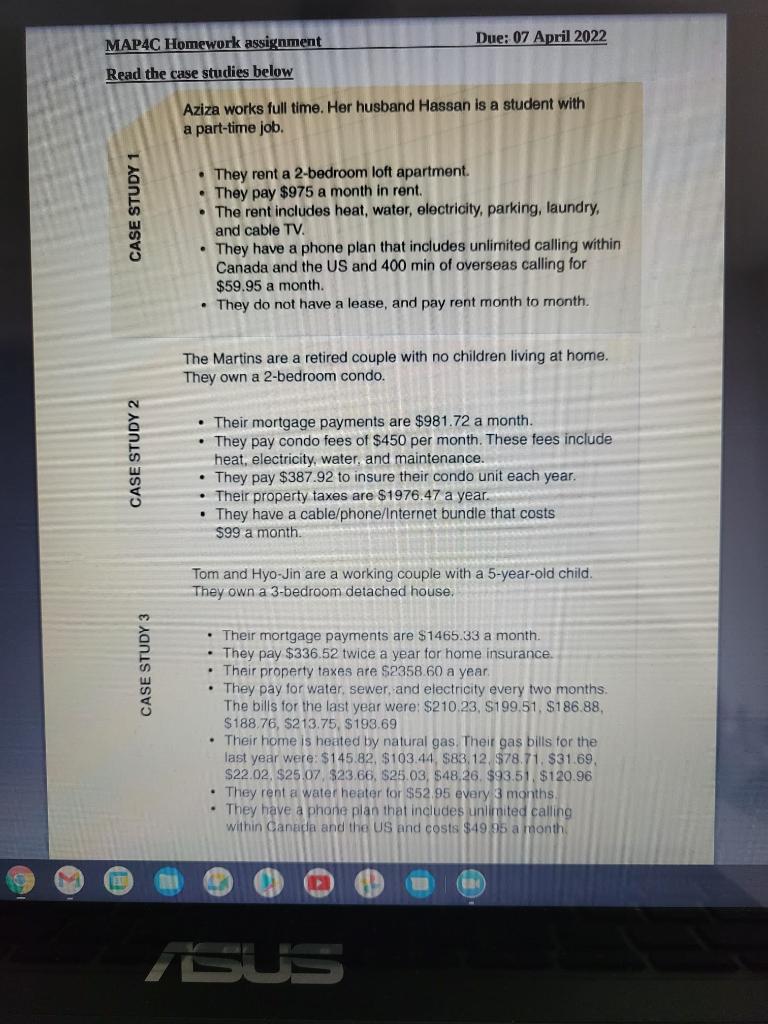

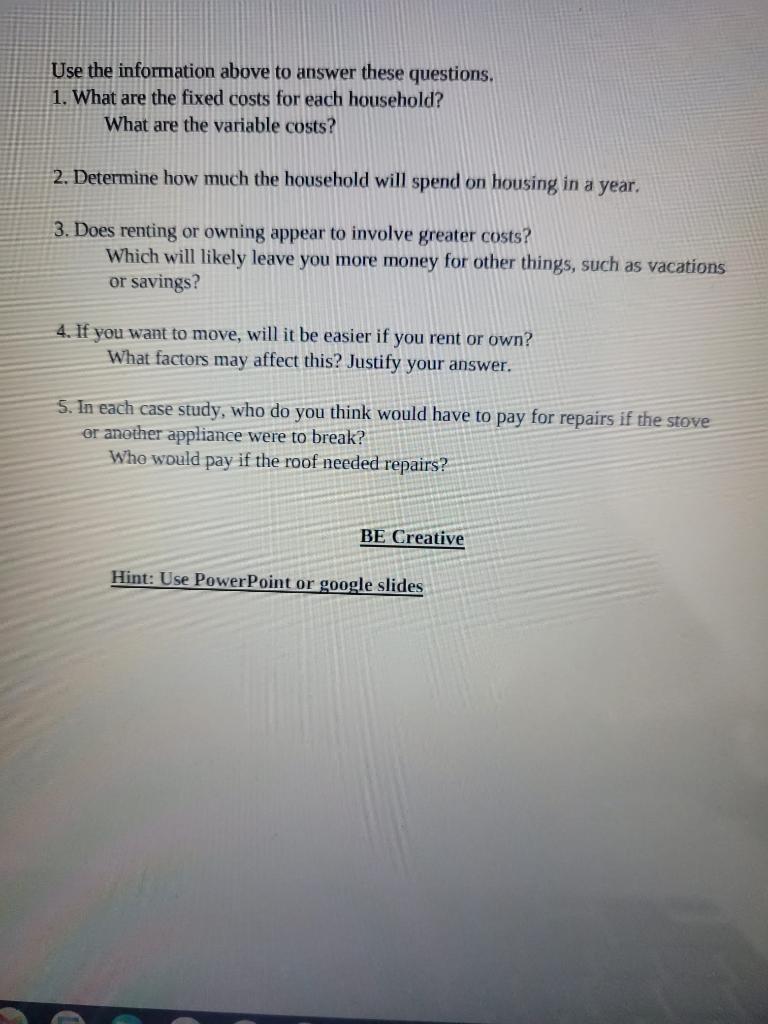

Due: 07 April 2022 MAP4C Homework assignment Read the case studies below Aziza works full time. Her husband Hassan is a student with a part-time job. CASE STUDY 1 They rent a 2-bedroom loft apartment. They pay $975 a month in rent. The rent includes heat, water, electricity, parking, laundry, and cable TV They have a phone plan that includes unlimited calling within Canada and the US and 400 min of overseas calling for $59.95 a month. They do not have a lease, and pay rent month to month The Martins are a retired couple with no children living at home. They own a 2-bedroom condo. CASE STUDY 2 Their mortgage payments are $981.72 a month. They pay condo fees of $450 per month. These fees include heat, electricity, water, and maintenance. They pay $387.92 to insure their condo unit each year. Their property taxes are $1976.47 a year. They have a cable/phone/Internet bundle that costs $99 a month. Tom and Hyo-Jin are a working couple with a 5-year-old child. They own a 3-bedroom detached house, CASE STUDY 3 Their mortgage payments are $1465.33 a month. They pay $336.52 twice a year for home insurance. Their property taxes are $2358.60 a year They pay for water, sewer, and electricity every two months The bills for the last year were: $210.23, S199.51, $186.88, $188.76, $213.75, $193.69 Their home is heated by natural gas. Their gas bills for the last year were: $145.82, $103.44 $83,12 $78.71 $31.69. $22.02. $25.07. $23.66, $25.03, $48,26. $93.51 $120.96 They rent a water heater for $52.95 every 3 months They have a phone plan that includes unlimited calling within Canada and the US and costs $49.95 a month ( ISUS Use the information above to answer these questions. 1. What are the fixed costs for each household? What are the variable costs? 2. Determine how much the household will spend on housing in a year. 3. Does renting or owning appear to involve greater costs? Which will likely leave you more money for other things, such as vacations or savings? 4. If you want to move, will it be easier if you rent or own? What factors may affect this? Justify your answer. 5. In each case study, who do you think would have to pay for repairs if the stove or another appliance were to break? Who would pay if the roof need repairs? BE Creative Hint: Use PowerPoint or google slides Due: 07 April 2022 MAP4C Homework assignment Read the case studies below Aziza works full time. Her husband Hassan is a student with a part-time job. CASE STUDY 1 They rent a 2-bedroom loft apartment. They pay $975 a month in rent. The rent includes heat, water, electricity, parking, laundry, and cable TV They have a phone plan that includes unlimited calling within Canada and the US and 400 min of overseas calling for $59.95 a month. They do not have a lease, and pay rent month to month The Martins are a retired couple with no children living at home. They own a 2-bedroom condo. CASE STUDY 2 Their mortgage payments are $981.72 a month. They pay condo fees of $450 per month. These fees include heat, electricity, water, and maintenance. They pay $387.92 to insure their condo unit each year. Their property taxes are $1976.47 a year. They have a cable/phone/Internet bundle that costs $99 a month. Tom and Hyo-Jin are a working couple with a 5-year-old child. They own a 3-bedroom detached house, CASE STUDY 3 Their mortgage payments are $1465.33 a month. They pay $336.52 twice a year for home insurance. Their property taxes are $2358.60 a year They pay for water, sewer, and electricity every two months The bills for the last year were: $210.23, S199.51, $186.88, $188.76, $213.75, $193.69 Their home is heated by natural gas. Their gas bills for the last year were: $145.82, $103.44 $83,12 $78.71 $31.69. $22.02. $25.07. $23.66, $25.03, $48,26. $93.51 $120.96 They rent a water heater for $52.95 every 3 months They have a phone plan that includes unlimited calling within Canada and the US and costs $49.95 a month ( ISUS Use the information above to answer these questions. 1. What are the fixed costs for each household? What are the variable costs? 2. Determine how much the household will spend on housing in a year. 3. Does renting or owning appear to involve greater costs? Which will likely leave you more money for other things, such as vacations or savings? 4. If you want to move, will it be easier if you rent or own? What factors may affect this? Justify your answer. 5. In each case study, who do you think would have to pay for repairs if the stove or another appliance were to break? Who would pay if the roof need repairs? BE Creative Hint: Use PowerPoint or google slides

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts