Question: Due before9pm Description All students must submit a PowerPoint presentation for potential investors. Keep in mind, the investment price must be stated in your Business

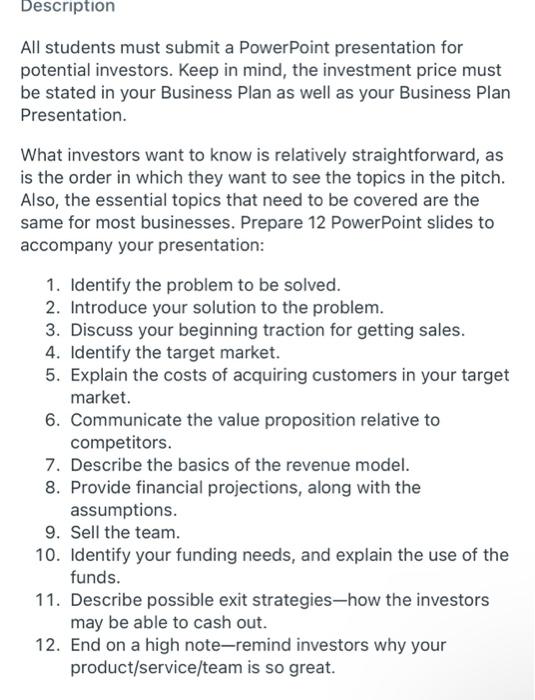

Description All students must submit a PowerPoint presentation for potential investors. Keep in mind, the investment price must be stated in your Business Plan as well as your Business Plan Presentation. What investors want to know is relatively straightforward, as is the order in which they want to see the topics in the pitch. Also, the essential topics that need to be covered are the same for most businesses. Prepare 12 PowerPoint slides to accompany your presentation: 1. Identify the problem to be solved. 2. Introduce your solution to the problem. 3. Discuss your beginning traction for getting sales. 4. Identify the target market. 5. Explain the costs of acquiring customers in your target market. 6. Communicate the value proposition relative to competitors. 7. Describe the basics of the revenue model. 8. Provide financial projections, along with the assumptions. 9. Sell the team. 10. Identify your funding needs, and explain the use of the funds. 11. Describe possible exit strategies-how the investors may be able to cash out. 12. End on a high note-remind investors why your product/service/team is so great. Description All students must submit a PowerPoint presentation for potential investors. Keep in mind, the investment price must be stated in your Business Plan as well as your Business Plan Presentation. What investors want to know is relatively straightforward, as is the order in which they want to see the topics in the pitch. Also, the essential topics that need to be covered are the same for most businesses. Prepare 12 PowerPoint slides to accompany your presentation: 1. Identify the problem to be solved. 2. Introduce your solution to the problem. 3. Discuss your beginning traction for getting sales. 4. Identify the target market. 5. Explain the costs of acquiring customers in your target market. 6. Communicate the value proposition relative to competitors. 7. Describe the basics of the revenue model. 8. Provide financial projections, along with the assumptions. 9. Sell the team. 10. Identify your funding needs, and explain the use of the funds. 11. Describe possible exit strategies-how the investors may be able to cash out. 12. End on a high note-remind investors why your product/service/team is so great

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts