Question: Due by today. please help, will give positive feedback. Bair & Rosen, Inc. (BSR), is a brokerage firm that spedalises in investment portfollos designed to

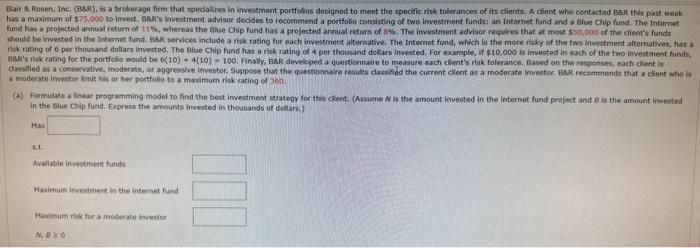

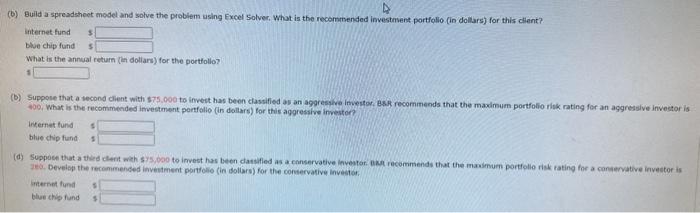

Bair \& Rosen, Inc. (BSR), is a brokerage firm that spedalises in investment portfollos designed to meot the sperific risk toleranoes of its cliants. A dient who contacted Bse the pist weok has a maximum of $75,000 to invest. BaR's investment advisoc deddes to recommend a portfollo consisting of two investment funds: an internet fund and a tlue Chip fund. The finternet fund has a projected annual retum of 11%, whereas the Alve Chip fund has a projected annual return of 8%. The ifvestisent advisor requires that at most sso,noo of the client's funds should be invested in the Intemet fund. Bsft services include a risk rating for each investment attomative. The internet fund, which is the more risky of the two inveatment atternatives, has a risk rating of 6 per thousand dallars invested. The tlue Chip fund has a risk rating of 4 per thousand dcflars inverted. For example, if $10,000 is invested in aach of the two investment funds, esk'l tisk rating for the portfolio would be 6(10)+4(10)=100. Finally, Bar develeped a questionnaire to measura each client's risk tolerance. Based on the responses, each client is dasolied as a conservative, moderate, or aggressive imvestor. Suppose that the questionnaire fesules dassifid the current client as a moderate investor. BSR recommende that a client who is a moderate ieveritor limit his ar her portfolio to a maximum tisk rating of 360 . (a) Formulate a linear programming model to find the best invectment strategy for thic client. (Assume N is the amount invested in the internet fund profect and B is the amount invested in the Blue Chip fund. Express the amounts invested in thousands of dollats.) Ayaliable investment funds Mavimum inyestmect in the internet fund Mavinum ritk for a moderate investor N,00 (b) Build a spreadsheot model and solve the problem using Excel Solver, What is the recommended investment portfollo. (in dollars) for this client? internet fund blue chip fund What is the annual return (ih dollars) for the portfolio? (b) Suppose that a second dient with $75,000 to invest has beon classified as an aggrespive investor, Bsit, recommends that the maximum portfoilo ritk rating for an aggressive investor is 400, What is the recommended investment pertfolio (in doilars) for this aggressive investon? incernet fund blue atvip fund (d) Suppose that a thes clent with sys,poo to invest has been clacsifled as a conservative investor. exgl recommende that the maimum portfollo risk rating for a canaervative investor is ato. Develap the recommenced investment portfolio (in sollars) for the conservative investor: internet fund blus chis fund Bair \& Rosen, Inc. (BSR), is a brokerage firm that spedalises in investment portfollos designed to meot the sperific risk toleranoes of its cliants. A dient who contacted Bse the pist weok has a maximum of $75,000 to invest. BaR's investment advisoc deddes to recommend a portfollo consisting of two investment funds: an internet fund and a tlue Chip fund. The finternet fund has a projected annual retum of 11%, whereas the Alve Chip fund has a projected annual return of 8%. The ifvestisent advisor requires that at most sso,noo of the client's funds should be invested in the Intemet fund. Bsft services include a risk rating for each investment attomative. The internet fund, which is the more risky of the two inveatment atternatives, has a risk rating of 6 per thousand dallars invested. The tlue Chip fund has a risk rating of 4 per thousand dcflars inverted. For example, if $10,000 is invested in aach of the two investment funds, esk'l tisk rating for the portfolio would be 6(10)+4(10)=100. Finally, Bar develeped a questionnaire to measura each client's risk tolerance. Based on the responses, each client is dasolied as a conservative, moderate, or aggressive imvestor. Suppose that the questionnaire fesules dassifid the current client as a moderate investor. BSR recommende that a client who is a moderate ieveritor limit his ar her portfolio to a maximum tisk rating of 360 . (a) Formulate a linear programming model to find the best invectment strategy for thic client. (Assume N is the amount invested in the internet fund profect and B is the amount invested in the Blue Chip fund. Express the amounts invested in thousands of dollats.) Ayaliable investment funds Mavimum inyestmect in the internet fund Mavinum ritk for a moderate investor N,00 (b) Build a spreadsheot model and solve the problem using Excel Solver, What is the recommended investment portfollo. (in dollars) for this client? internet fund blue chip fund What is the annual return (ih dollars) for the portfolio? (b) Suppose that a second dient with $75,000 to invest has beon classified as an aggrespive investor, Bsit, recommends that the maximum portfoilo ritk rating for an aggressive investor is 400, What is the recommended investment pertfolio (in doilars) for this aggressive investon? incernet fund blue atvip fund (d) Suppose that a thes clent with sys,poo to invest has been clacsifled as a conservative investor. exgl recommende that the maimum portfollo risk rating for a canaervative investor is ato. Develap the recommenced investment portfolio (in sollars) for the conservative investor: internet fund blus chis fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts