Question: due soon need help ASAP thank you Problem 1 (12 points) Vinci, Inc.'s auditor observes the following related to Vinci's Cash account balance as of

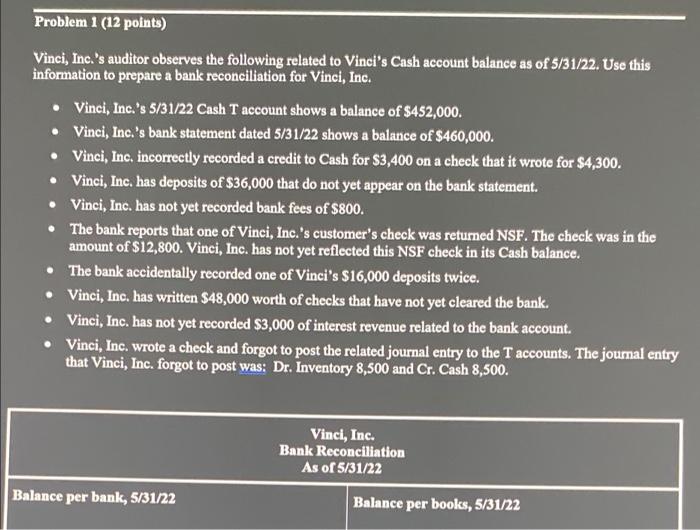

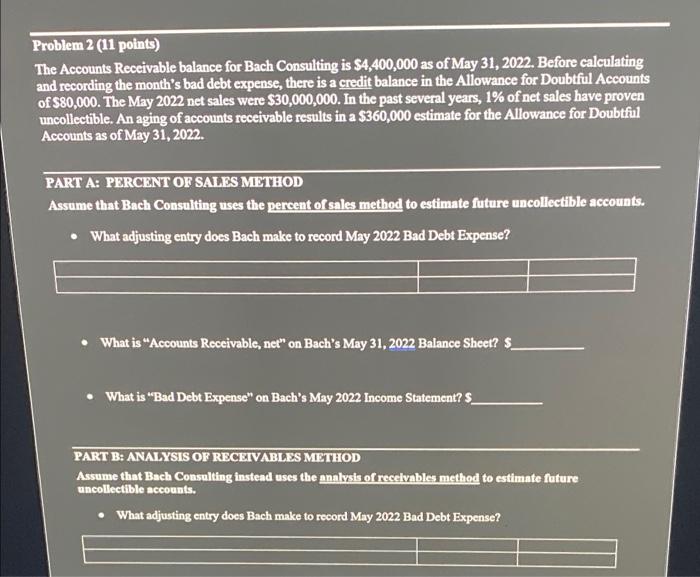

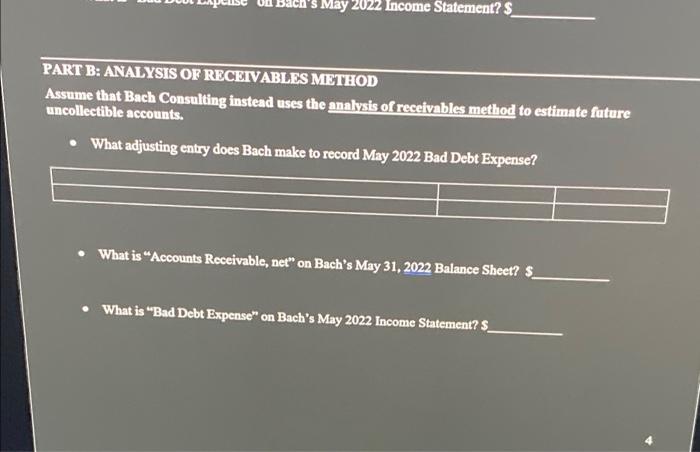

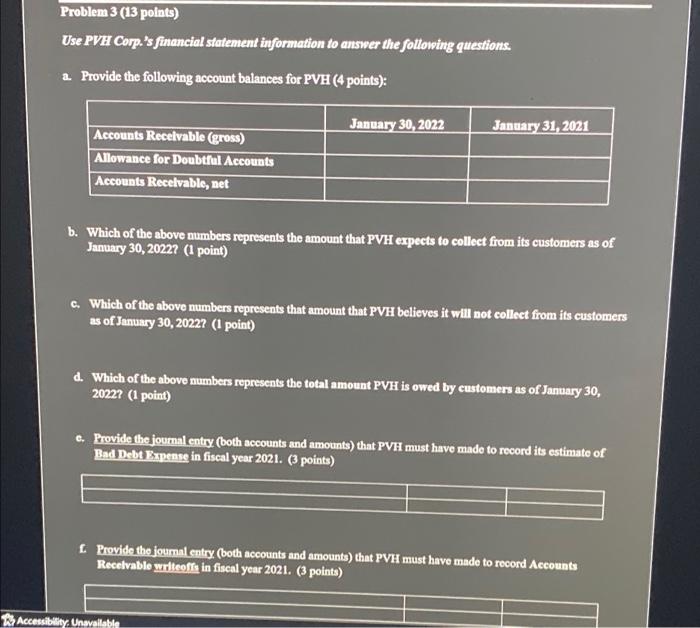

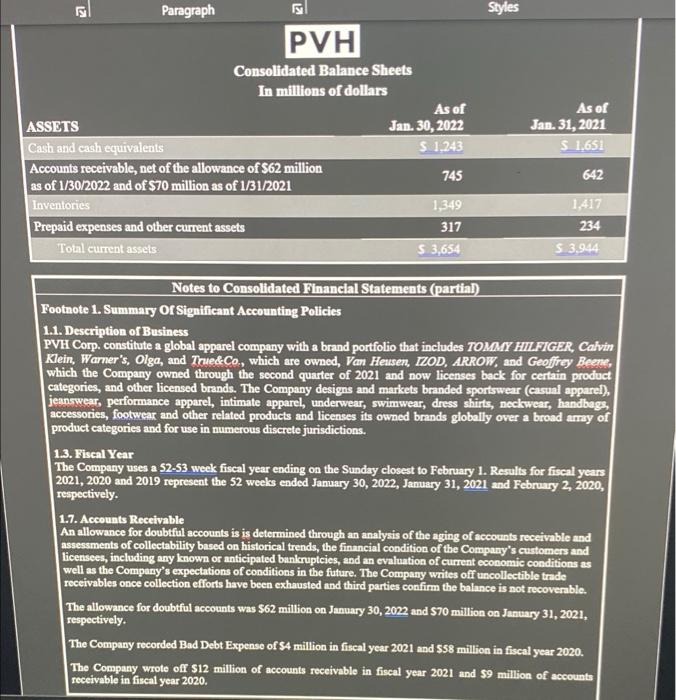

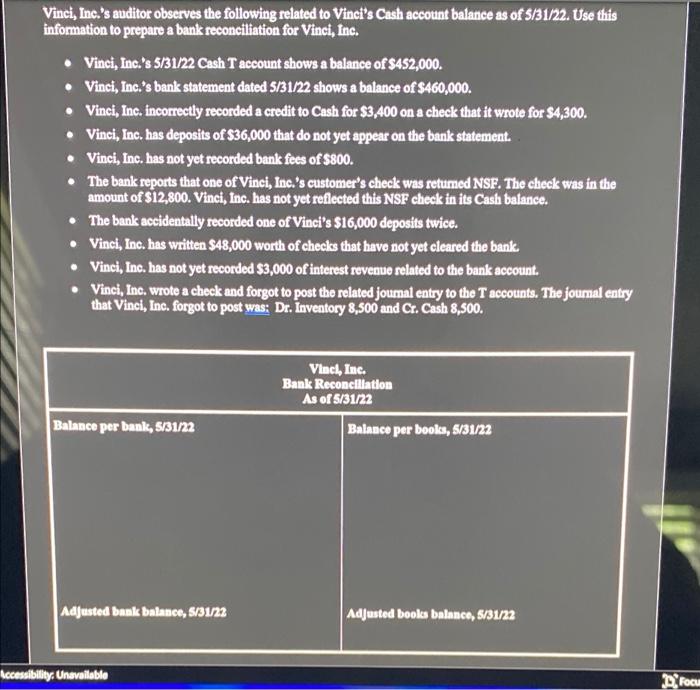

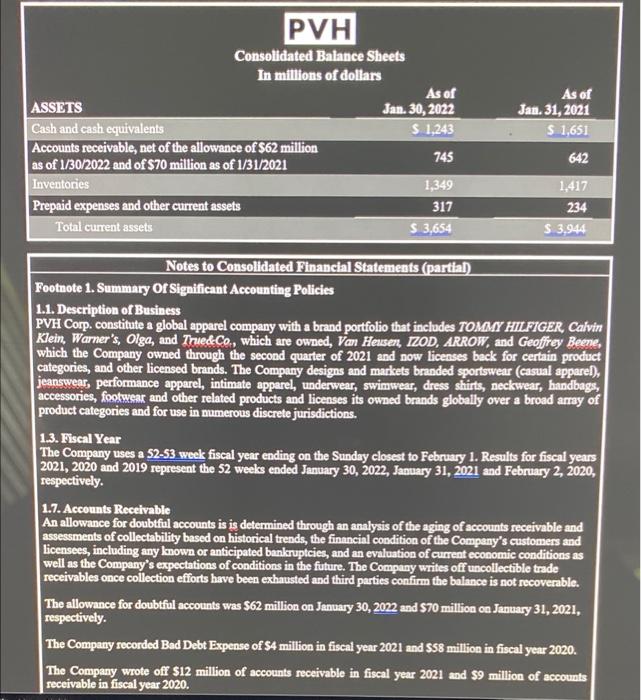

Problem 1 (12 points) Vinci, Inc.'s auditor observes the following related to Vinci's Cash account balance as of 5/31/22. Use this information to prepare a bank reconciliation for Vinci, Inc. Vinci, Inc.'s 5/31/22 Cash T account shows a balance of $452,000. Vinci, Inc.'s bank statement dated 5/31/22 shows a balance of $460,000. Vinci, Inc. incorrectly recorded a credit to Cash for $3,400 on a check that it wrote for $4,300. Vinci, Inc. has deposits of $36,000 that do not yet appear on the bank statement. Vinci, Inc. has not yet recorded bank fees of $800. The bank reports that one of Vinci, Inc.'s customer's check was returned NSF. The check was in the amount of $12,800. Vinci, Inc. has not yet reflected this NSF check in its Cash balance. The bank accidentally recorded one of Vinci's $16,000 deposits twice. Vinci, Inc. has written $48,000 worth of checks that have not yet cleared the bank. Vinci, Inc. has not yet recorded $3,000 of interest revenue related to the bank account. Vinci, Inc. wrote a check and forgot to post the related journal entry to the T accounts. The journal entry that Vinci, Inc. forgot to post was: Dr. Inventory 8,500 and Cr. Cash 8,500. Vinci, Inc. Bank Reconciliation As of 5/31/22 Balance per bank, 5/31/22 Balance per books, 5/31/22 Problem 2 (11 points) The Accounts Receivable balance for Bach Consulting is $4,400,000 as of May 31, 2022. Before calculating and recording the month's bad debt expense, there is a credit balance in the Allowance for Doubtful Accounts of $80,000. The May 2022 net sales were $30,000,000. In the past several years, 1% of net sales have proven uncollectible. An aging of accounts receivable results in a $360,000 estimate for the Allowance for Doubtful Accounts as of May 31, 2022. PART A: PERCENT OF SALES METHOD Assume that Bach Consulting uses the percent of sales method to estimate future uncollectible accounts. What adjusting entry does Bach make to record May 2022 Bad Debt Expense? What is "Accounts Receivable, net" on Bach's May 31, 2022 Balance Sheet? $_ What is "Bad Debt Expense" on Bach's May 2022 Income Statement? $_ PART B: ANALYSIS OF RECEIVABLES METHOD Assume that Bach Consulting instead uses the analysis of recelyables method to estimate future uncollectible accounts. What adjusting entry does Bach make to record May 2022 Bad Debt Expense? S May 2022 Income Statement? $_ PART B: ANALYSIS OF RECEIVABLES METHOD Assume that Bach Consulting instead uses the analysis of receivables method to estimate future uncollectible accounts. What adjusting entry does Bach make to record May 2022 Bad Debt Expense? What is "Accounts Receivable, net on Bach's May 31, 2022 Balance Sheet? $ What is "Bad Debt Expense" on Bach's May 2022 Income Statement? $_ Problem 3 (13 points) Use PVH Corp.'s financial statement information to answer the following questions. a Provide the following account balances for PVH (4 points): January 30, 2022 January 31, 2021 Accounts Receivable (gross) Allowance for Doubtful Accounts Accounts Receivable, net b. Which of the above numbers represents the amount that PVH expects to collect from its customers as of January 30, 2022? (1 point) c. Which of the above numbers represents that amount that PVH believes it will not collect from its customers as of January 30, 2022? (1 point) d. Which of the above numbers represents the total amount PVH is owed by customers as of January 30, 2022? (1 point) Provide the journal entry (both accounts and amounts) that PVH must have made to record its estimate of Bad Debt Expense in fiscal year 2021. (3 points) Provide the journal entry (both accounts and amounts) that PVH must have made to record Accounts Receivable wrlteoffs in fiscal year 2021. (3 points) Accessibility. Unavailable KU Styles Paragraph PVH Consolidated Balance Sheets In millions of dollars As of ASSETS Jan. 30, 2022 Cash and cash equivalents $ 1.243 Accounts receivable, net of the allowance of $62 million as of 1/30/2022 and of $70 million as of 1/31/2021 745 Inventories 1,349 Prepaid expenses and other current assets 317 Total current assets $ 3,654 As of Jan. 31, 2021 S 1,651 642 1,417 234 S 3,944 Notes to Consolidated Financial Statements (partial) Footnote 1. Summary or Significant Accounting Policies 1.1. Description of Business PVH Corp. constitute a global apparel company with a brand portfolio that includes TOMMY HILFIGER, Calvin Klein, Warner's, Olga, and True&Co., which are owned, Van Heusen, IZOD, ARROW, and Geoffrey Beene, which the Company owned through the second quarter of 2021 and now licenses back for certain product categories, and other licensed brands. The Company designs and markets branded sportswear (casual apparel), jeanswear, performance apparel, intimate apparel, underwear, swimwear, dress shirts, neckwear, handbags, accessories, footwear and other related products and licenses its owned brands globally over a broad array of product categories and for use in numerous discrete jurisdictions. 1.3. Fiscal Year The Company uses a S2-3 week fiscal year ending on the Sunday closest to February 1. Results for fiscal years 2021, 2020 and 2019 represent the 52 weeks ended January 30, 2022, January 31, 2021 and February 2, 2020, respectively. 1.7. Accounts Receivable An allowance for doubtful accounts is is determined through an analysis of the aging of accounts receivable and assessments of collectability based on historical trends, the financial condition of the Company's customers and licensees, including any known or anticipated bankruptcies, and an evaluation of current economic conditions as well as the Company's expectations of conditions in the future. The Company writes off uncollectible trade receivables once collection efforts have been exhausted and third parties confirm the balance is not recoverable. The allowance for doubtful accounts was $62 million on January 30, 2022 and $70 million on January 31, 2021, respectively. The Company recorded Bad Debt Expense of S4 million in fiscal year 2021 and 558 million in fiscal year 2020. The Company wrote off $12 million of accounts receivable in fiscal year 2021 and $9 million of accounts receivable in fiscal year 2020. Vinci, Inc.'s auditor observes the following related to Vinci's Cash account balance as of 5/31/22. Use this information to prepare a bank reconciliation for Vinci, Inc. Vinci, Inc.'s 5/31/22 Cash T account shows a balance of $452,000. Vinci, Inc.'s bank statement dated 5/31/22 shows a balance of $460,000. Vinci, Inc. incorrectly recorded a credit to Cash for $3,400 on a check that it wrote for S4,300. Vinci, Inc. has deposits of $36,000 that do not yet appear on the bank statement. Vinci, Inc. has not yet recorded bank fees of $800. The bank reports that one of Vinci, Inc.'s customer's check was retumed NSF. The check was in the amount of $12,800. Vinci, Inc. has not yet reflected this NSF check in its Cash balance. The bank accidentally recorded one of Vinci's $16,000 deposits twice. Vinci, Inc. has written 548,000 worth of chocks that have not yet cleared the bank Vinci, Inc. has not yet recorded $3,000 of interest revenue related to the bank account. Vinci, Inc. wrote a chock and forgot to post the related journal entry to the T accounts. The journal entry that Vinci, Inc. forgot to post was: Dr. Inventory 8,500 and Cr. Cash 8,500. Vinel, Inc. Bank Reconciliation As of 5/31/22 Balance per books, 5/31/22 Balance per bank, 5/31/22 Adjusted bank balance, 5/31/22 Adjusted books balance, 5/31/22 Accessibility: Unavailable Focu As of PVH Consolidated Balance Sheets In millions of dollars ASSETS Jan. 30, 2022 Cash and cash equivalents $ 1,243 Accounts receivable, net of the allowance of $62 million 745 as of 1/30/2022 and of $70 million as of 1/31/2021 Inventories 1,349 Prepaid expenses and other current assets 317 Total current assets S 3,654 As of Jan. 31, 2021 $ 1,651 642 1,417 234 S 3,944 Notes to Consolidated Financial Statements (partial) Footnote 1. Summary or Significant Accounting Policies 1.1. Description of Business PVH Corp. constitute a global apparel company with a brand portfolio that includes TOMMY HILFIGER, Calvin Klein, Warner's, Olga, and True&Co., which are owned, Van Heusen, IZOD, ARROW, and Geoffrey Beene, which the Company owned through the second quarter of 2021 and now licenses back for certain product categories, and other licensed brands. The Company designs and markets branded sportswear (casual apparel), jeanswear, performance apparel, intimate apparel, underwear, swimwear, dress shirts, neckwear, handbags, accessories, footwear and other related products and licenses its owned brands globally over a broad array of product categories and for use in numerous discrete jurisdictions. 1.3. Fiscal Year The Company uses a 52-53 week fiscal year ending on the Sunday closest to February 1. Results for fiscal years 2021, 2020 and 2019 represent the 52 weeks ended January 30, 2022, January 31, 2021 and February 2, 2020, respectively. 1.7. Accounts Receivable An allowance for doubtful accounts is is determined through an analysis of the aging of accounts receivable and assessments of collectability based on historical trends, the financial condition of the Company's customers and Licensees, including any known or anticipated bankruptcies, and an evaluation of current economic conditions as well as the Company's expectations of conditions in the future. The Company writes off uncollectible trade receivables once collection efforts have been exhausted and third parties confirm the balance is not recoverable. The allowance for doubtful accounts was $62 million on January 30, 2022 and $70 million on January 31, 2021, respectively. The Company recorded Bad Debt Expense of S4 million in fiscal year 2021 and $58 million in fiscal year 2020. The Company wrote off $12 million of accounts receivable in fiscal year 2021 and $9 million of accounts receivable in fiscal year 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts