Question: Due to a high demand for corn as a source of ethanol fuel production, a farmer is considering planting more corn, which requires the purchase

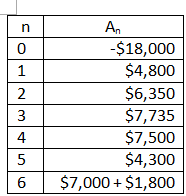

Due to a high demand for corn as a source of ethanol fuel production, a farmer is considering planting more corn, which requires the purchase of a new, larger row crop planter. The planter will cost $18,000 and has an expected service life of six years, with the salvage value of 10% of the initial purchase price. The new planter allows the farmer to plant crops in less time and to increase average crop yields. The net cash flow from this more efficient planter is as follows:

What is the net present value for this purchase if the farmer's interest rate os 9%?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts