Question: Due today, please help Question 4 (18 marks) Desert Design, a retailer, has recently appointed a new bookkeeper. She ascertained that some adjustment had not

Due today, please help

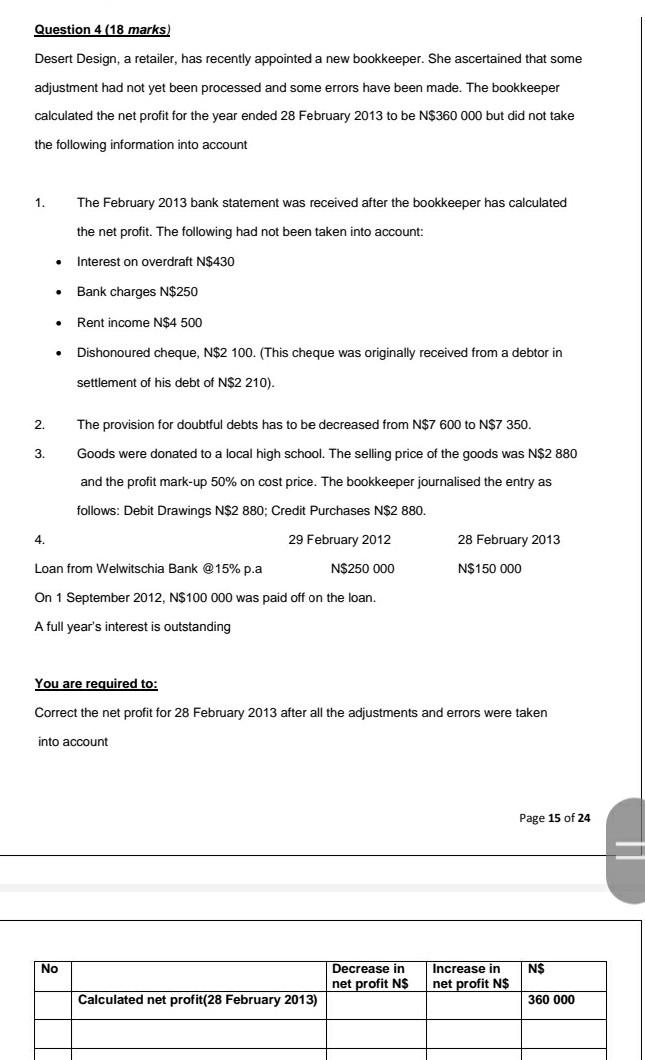

Question 4 (18 marks) Desert Design, a retailer, has recently appointed a new bookkeeper. She ascertained that some adjustment had not yet been processed and some errors have been made. The bookkeeper calculated the net profit for the year ended 28 February 2013 to be N$360 000 but did not take the following information into account 1. The February 2013 bank statement was received after the bookkeeper has calculated the net profit. The following had not been taken into account: Interest on overdraft N$430 . Bank charges N$250 Rent income N$4 500 Dishonoured cheque, N$2 100. (This cheque was originally received from a debtor in settlement of his debt of N$2 210). 2 The provision for doubtful debts has to be decreased from N$7 600 to N$7 350. 3. Goods were donated to a local high school. The selling price of the goods was N$2 880 and the profit mark-up 50% on cost price. The bookkeeper journalised the entry as follows: Debit Drawings N$2 880; Credit Purchases N$2 880. 4. 29 February 2012 28 February 2013 Loan from Welwitschia Bank @ 15% p.a N$250 000 NS150 000 On 1 September 2012, N$100 000 was paid off on the loan. A full year's interest is outstanding You are required to: Correct the net profit for 28 February 2013 after all the adjustments and errors were taken into account Page 15 of 24 No N$ Decrease in net profit N$ Increase in net profit N$ Calculated net profit(28 February 2013) 360 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts