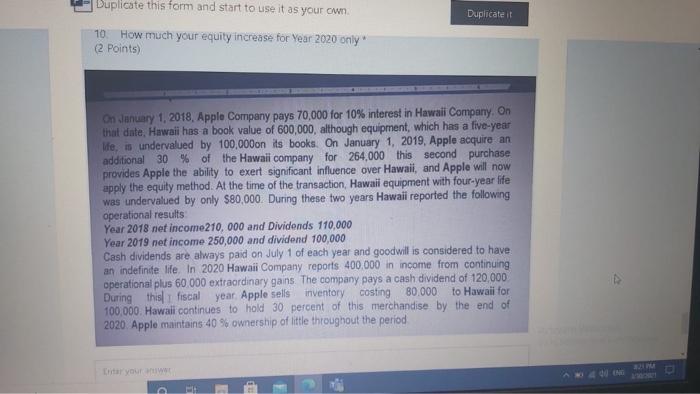

Question: Duplicate this form and start to use it as your own Duplicate it 10 How much your equity increase for Year 2020 only (2 points)

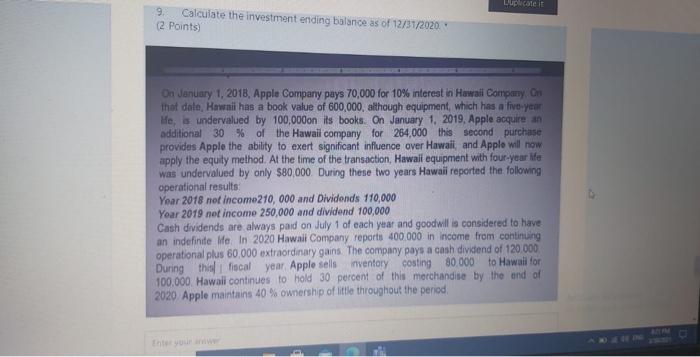

Duplicate this form and start to use it as your own Duplicate it 10 How much your equity increase for Year 2020 only (2 points) On January 1, 2018. Apple Company pays 70,000 for 10% interest in Hawaii Company. On that date, Hawaii has a book value of 600,000, although equipment, which has a five-year life is undervalued by 100,000 on its books. On January 1, 2019, Apple acquire an additional 30 % of the Hawaii company for 264,000 this second purchase provides Apple the ability to exert significant influence over Hawaii, and Apple will now apply the equity method. At the time of the transaction, Hawaii equipment with four-year life was undervalued by only $80,000. During these two years Hawaii reported the following operational results Year 2018 net income210,000 and Dividends 110,000 Year 2019 net income 250,000 and dividend 100,000 Cash dividends are always paid on July 1 of each year and goodwill is considered to have an indefinite life. In 2020 Hawaii Company reports 400.000 in income from continuing operational plus 60.000 extraordinary gains. The company pays a cash dividend of 120,000 During this fiscal year Apple sells inventory costing 80.000 to Hawaii for 100,000. Hawaii continues to hold 30 percent of this merchandise by the end of 2020. Apple maintains 40 % ownership of little throughout the period Titar ur we D Lupole 9 Calculate the investment ending balance as of 12/31/2020. (2 Points) On January 1, 2018. Apple Company pays 70,000 for 10% interest in Hawaii Company on ihat date, Hawaii has a book value of 600,000, although equipment, which has a five-year He is undervalued by 100,000 on its books. On January 1, 2019. Apple acquire an additional 30% of the Hawail company for 264,000 this second purchase provides Apple the ability to exert significant influence over Hawail and Apple will now apply the equity method. At the time of the transaction, Hawaii equipment with four-year life was undervalued by only $80,000. During these two years Hawaii reported the following operational results Year 2018 net income210,000 and Dividends 110,000 Year 2019 net income 250,000 and dividend 100,000 Cash dividends are always paid on July 1 of each year and goodwill considered to have an indefinite life in 2020 Hawaii Company reports 400.000 in income from continuing operational plus 60.000 extraordinary gains. The company pays a cash dividend of 120.000 During this fiscal year Apple sells nventory costing 80.000 to Hawail for 100.000 Hawall continues to hold 30 percent of this merchandise by the end of 2020. Apple maintains 40% ownership of little throughout the period Duplicate this form and start to use it as your own Duplicate it 10 How much your equity increase for Year 2020 only (2 points) On January 1, 2018. Apple Company pays 70,000 for 10% interest in Hawaii Company. On that date, Hawaii has a book value of 600,000, although equipment, which has a five-year life is undervalued by 100,000 on its books. On January 1, 2019, Apple acquire an additional 30 % of the Hawaii company for 264,000 this second purchase provides Apple the ability to exert significant influence over Hawaii, and Apple will now apply the equity method. At the time of the transaction, Hawaii equipment with four-year life was undervalued by only $80,000. During these two years Hawaii reported the following operational results Year 2018 net income210,000 and Dividends 110,000 Year 2019 net income 250,000 and dividend 100,000 Cash dividends are always paid on July 1 of each year and goodwill is considered to have an indefinite life. In 2020 Hawaii Company reports 400.000 in income from continuing operational plus 60.000 extraordinary gains. The company pays a cash dividend of 120,000 During this fiscal year Apple sells inventory costing 80.000 to Hawaii for 100,000. Hawaii continues to hold 30 percent of this merchandise by the end of 2020. Apple maintains 40 % ownership of little throughout the period Titar ur we D Lupole 9 Calculate the investment ending balance as of 12/31/2020. (2 Points) On January 1, 2018. Apple Company pays 70,000 for 10% interest in Hawaii Company on ihat date, Hawaii has a book value of 600,000, although equipment, which has a five-year He is undervalued by 100,000 on its books. On January 1, 2019. Apple acquire an additional 30% of the Hawail company for 264,000 this second purchase provides Apple the ability to exert significant influence over Hawail and Apple will now apply the equity method. At the time of the transaction, Hawaii equipment with four-year life was undervalued by only $80,000. During these two years Hawaii reported the following operational results Year 2018 net income210,000 and Dividends 110,000 Year 2019 net income 250,000 and dividend 100,000 Cash dividends are always paid on July 1 of each year and goodwill considered to have an indefinite life in 2020 Hawaii Company reports 400.000 in income from continuing operational plus 60.000 extraordinary gains. The company pays a cash dividend of 120.000 During this fiscal year Apple sells nventory costing 80.000 to Hawail for 100.000 Hawall continues to hold 30 percent of this merchandise by the end of 2020. Apple maintains 40% ownership of little throughout the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts