Question: Duration Gap - Assignment Three investors invest in the same 10-year 8% annual coupon bond. They bought the bond at the same price ($85.503075 for

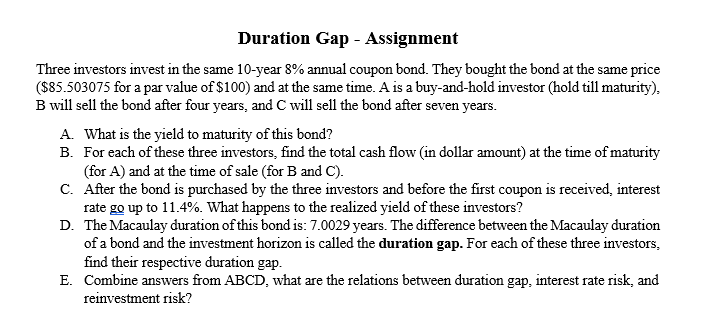

Duration Gap - Assignment Three investors invest in the same 10-year 8% annual coupon bond. They bought the bond at the same price ($85.503075 for a par value of $100) and at the same time. A is a buy-and-hold investor (hold till maturity), B will sell the bond after four years, and C will sell the bond after seven years. A. What is the yield to maturity of this bond? B. For each of these three investors, find the total cash flow (in dollar amount) at the time of maturity (for A) and at the time of sale (for B and C). C. After the bond is purchased by the three investors and before the first coupon is received, interest rate go up to 11.4%. What happens to the realized yield of these investors? D. The Macaulay duration of this bond is: 7.0029 years. The difference between the Macaulay duration of a bond and the investment horizon is called the duration gap. For each of these three investors, find their respective duration gap. E. Combine answers from ABCD, what are the relations between duration gap, interest rate risk, and reinvestment risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts