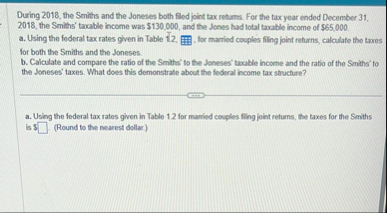

Question: During 2 0 1 8 , the Smiths and the Joneses both filed joint tax returns. For the tax year ended December 3 1 ,

During the Smiths and the Joneses both filed joint tax returns. For the tax year ended December the Senith's taxable income was $ and the Jones had total taxable income of $

a Using the federal tax rates given in Table for married couples filing joint relurns, calculate the taxes for both the Smiths and the Joneses.

b Calculate and compare the ratio of the Smiths' to the Joneses' tarable income and the ratio of the Smilths' to the Joneses' laxes. What does this demonstrate about the federal income tax structure?

a Using the federal tax rates given in Table for manied couples fling joint returns, the taxes for the Smiths is $ Round to the nearest dollar

b Calculate and compare the ratio of the Smiths' to the Joneses' taxabl the Joneses' taxes. What does this demonstrate about the federal incom

Data table

Click the icon here in order to copy the contents of the data table below into a spreadsheet.

TABLE : Tax Rates and Income Brackets for Joint Returns

tabletableTaxable IncomeTax Rates Joint Returns$ to $$ to $ $ to $$ to $$ to $$ to $Over $

text pages

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock