Question: During 2 0 2 1 , Lee's Book Store paid $ 2 7 3 , 0 0 0 for land and built a store in

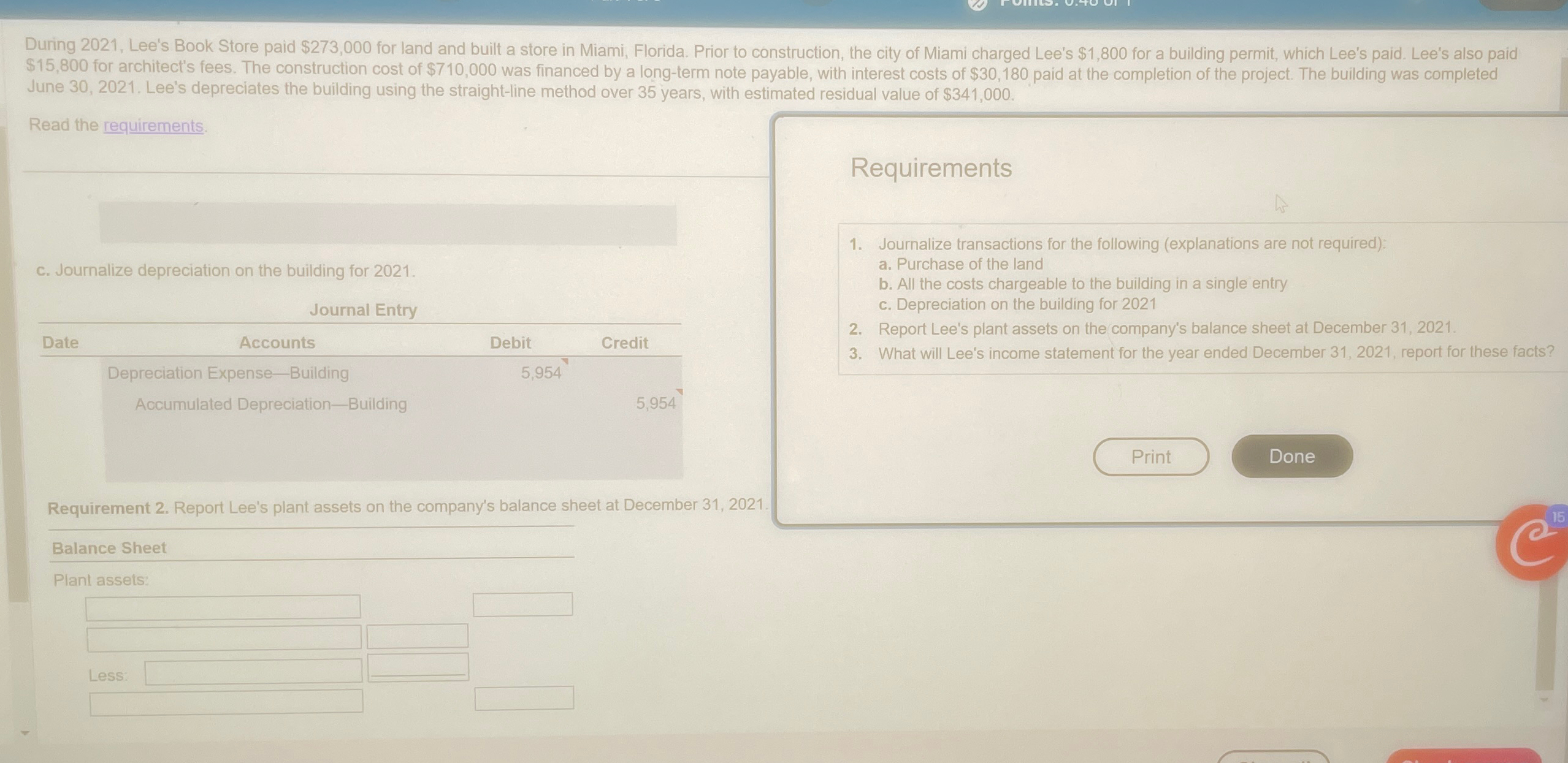

During Lee's Book Store paid $ for land and built a store in Miami, Florida. Prior to construction, the city of Miami charged Lee's $ for a building permit, which Lee's paid. Lee's also paid $ for architect's fees. The construction cost of $ was financed by a longterm note payable, with interest costs of $ paid at the completion of the project. The building was completed June Lee's depreciates the building using the straightline method over years, with estimated residual value of $

Read the requirements.

Requirements

c Journalize depreciation on the building for

Journal Entry

tableDateAccounts,Debit,CreditDepreciation ExpenseBuilding,Accumulated DepreciationBuilding,,

Requirement Report Lee's plant assets on the company's balance sheet at December

Batance Sheet

Plant assets:

Less:

Journalize transactions for the following explanations are not required:

a Purchase of the land

b All the costs chargeable to the building in a single entry

c Depreciation on the building for

Report Lee's plant assets on the company's balance sheet at December

What will Lee's income statement for the year ended December report for these facts?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock