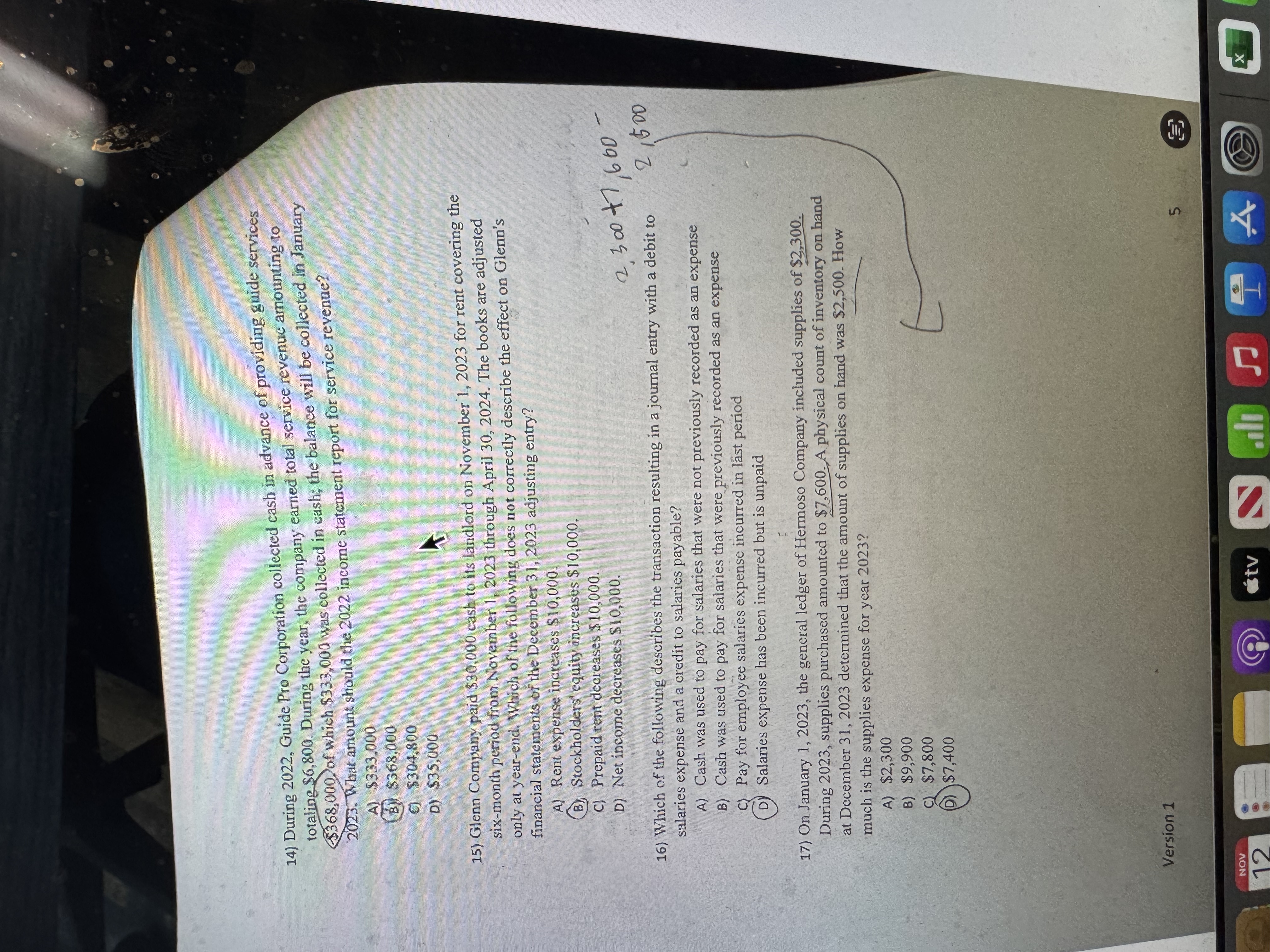

Question: During 2 0 2 2 , Guide Pro Corporation collected cash in advance of providing guide services totaling $ 6 , 8 0 0 .

During Guide Pro Corporation collected cash in advance of providing guide services totaling $ During the year, the company earned total service revenue amounting to $ of which $ was collected in cash; the balance will be collected in January What amount should the income statement report for service revenue?

A $

B $

C $

D $

Glenn Company paid $ cash to its landlord on November for rent covering the sixmonth period from November through April The books are adjusted only at yearend. Which of the following does not correctly describe the effect on Glenn's financial statements of the December adjusting entry?

A Rent expense increases $

B Stockholders' equity increases $

C Prepaid rent decreases $

D Net income decreases $

Which of the following describes the transaction resulting in a journal entry with a debit to salaries expense and a credit to salaries payable?

A Cash was used to pay for salaries that were not previously recorded as an expense

B Cash was used to pay for salaries that were previously recorded as an expense

C Pay for employee salaries expense incurred in last period

D Salaries expense has been incurred but is unpaid

On January the general ledger of Hermoso Company included supplies of $ During supplies purchased amounted to $ A physical count of inventory on hand at December determined that the amount of supplies on hand was $ How much is the supplies expense for year

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock