Question: During 2 0 2 3 , Sophie ( a self - employed marketing consultant ) went from Omaha to Lima, Peru, on business. She spent

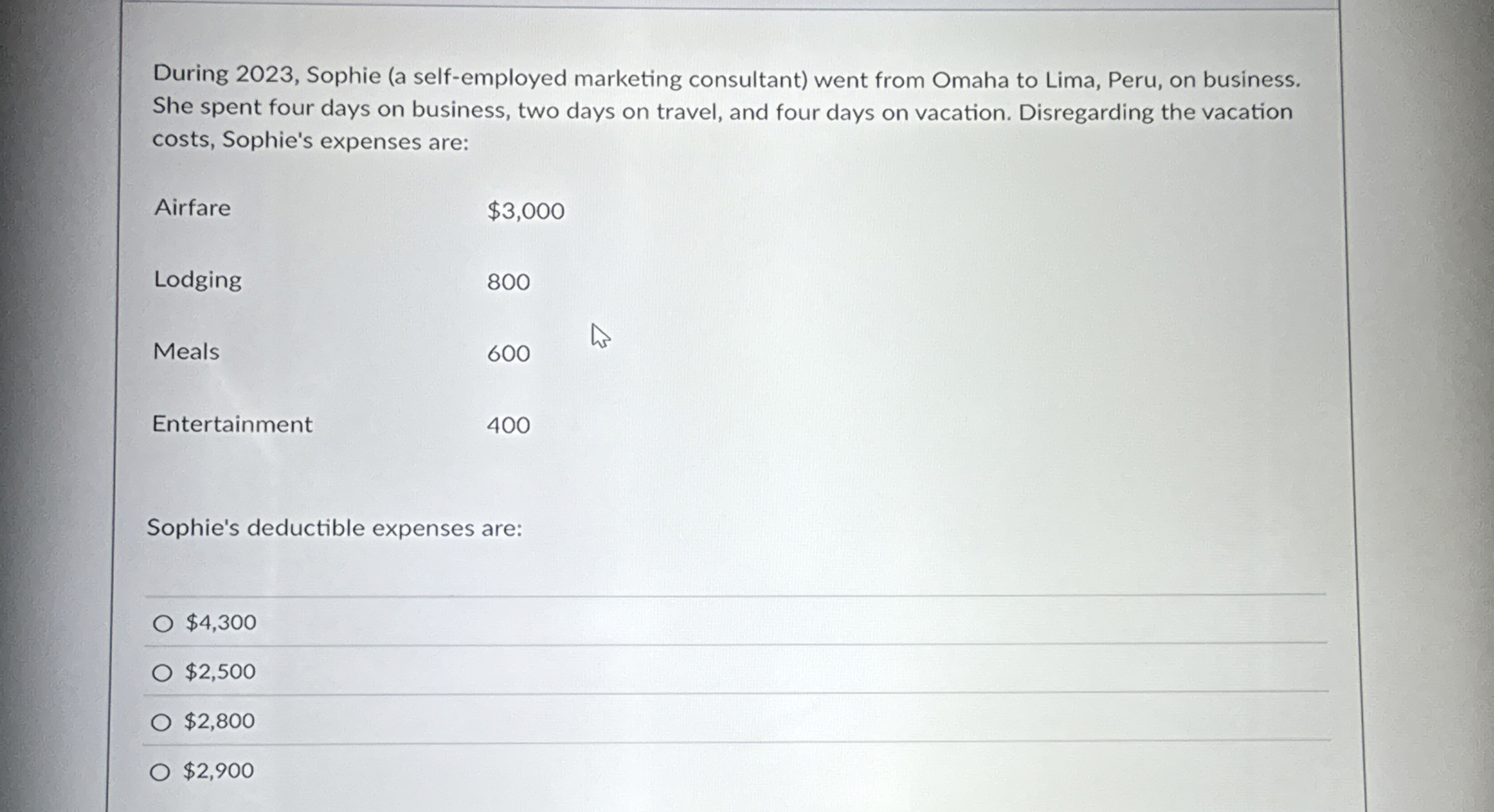

During Sophie a selfemployed marketing consultant went from Omaha to Lima, Peru, on business. She spent four days on business, two days on travel, and four days on vacation. Disregarding the vacation costs, Sophie's expenses are:

Airfare

$

Lodging

Meals

Entertainment

Sophie's deductible expenses are:

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock