Question: During 2 0 2 4 Bruno started his own Karate business. His business is a private corporation. He provides Karate lessons for kids from 4

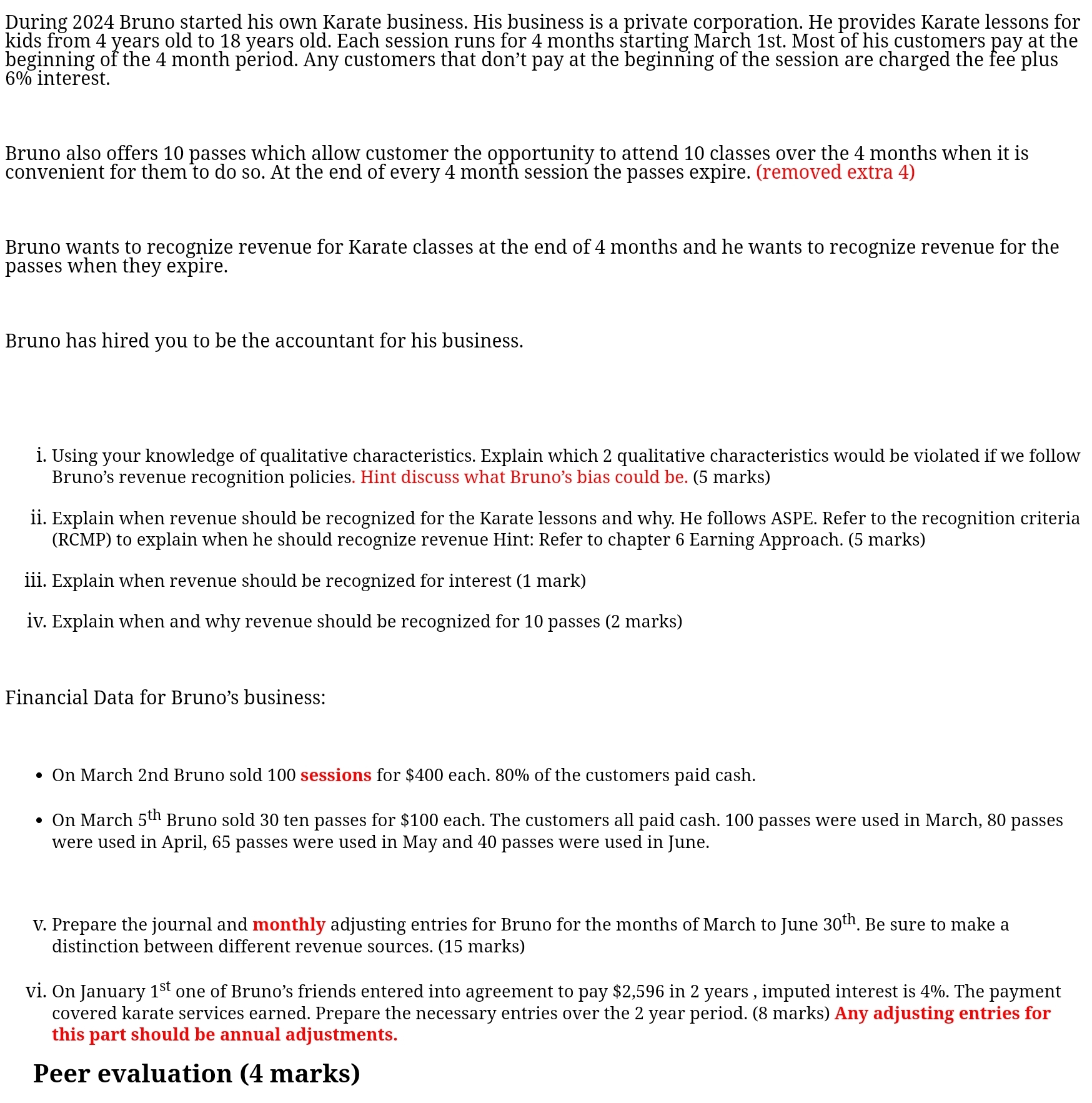

During Bruno started his own Karate business. His business is a private corporation. He provides Karate lessons for kids from years old to years old. Each session runs for months starting March st Most of his customers pay at the beginning of the month period. Any customers that don't pay at the beginning of the session are charged the fee plus interest.

Bruno also offers passes which allow customer the opportunity to attend classes over the months when it is convenient for them to do so At the end of every month session the passes expire. removed extra

Bruno wants to recognize revenue for Karate classes at the end of months and he wants to recognize revenue for the passes when they expire.

Bruno has hired you to be the accountant for his business.

i Using your knowledge of qualitative characteristics. Explain which qualitative characteristics would be violated if we follow Bruno's revenue recognition policies. Hint discuss what Bruno's bias could be marks

ii Explain when revenue should be recognized for the Karate lessons and why. He follows ASPE. Refer to the recognition criteria RCMP to explain when he should recognize revenue Hint: Refer to chapter Earning Approach. marks

iii. Explain when revenue should be recognized for interest mark

iv Explain when and why revenue should be recognized for passes marks

Financial Data for Bruno's business:

On March nd Bruno sold sessions for $ each. of the customers paid cash.

On March text th Bruno sold ten passes for $ each. The customers all paid cash. passes were used in March, passes were used in April, passes were used in May and passes were used in June.

v Prepare the journal and monthly adjusting entries for Bruno for the months of March to June text th Be sure to make a distinction between different revenue sources. marks

vi On January text st one of Bruno's friends entered into agreement to pay $ in years imputed interest is The payment covered karate services earned. Prepare the necessary entries over the year period. marks Any adjusting entries for this part should be annual adjustments.

Peer evaluation marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock