Question: During 2 0 2 4 , Richard and Greta Van Fleet, who are married and have 2 dependent children ( ages 1 6 ( in

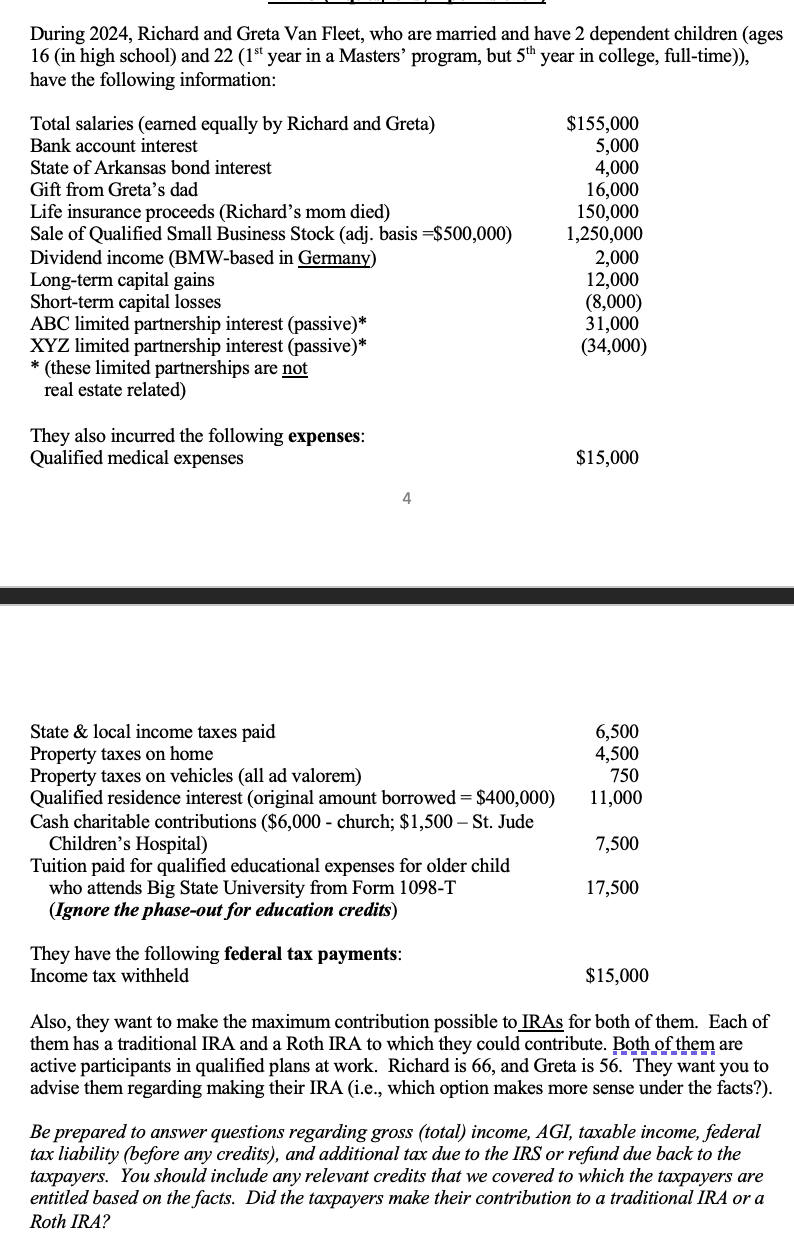

During Richard and Greta Van Fleet, who are married and have dependent children ages in high school and text st year in a Masters' program, but text th year in college, fulltime have the following information:these limited partnerships are not real estate related

They also incurred the following expenses:

Qualified medical expenses $Cash charitable contributions $ church; $ St Jude Children's HospitalTuition paid for qualified educational expenses for older child who attends Big State University from Form T

Ignore the phaseout for education credits

They have the following federal tax payments:

Income tax withheld $

Also, they want to make the maximum contribution possible to IRAs for both of them. Each of them has a traditional IRA and a Roth IRA to which they could contribute. Both of them are active participants in qualified plans at work. Richard is and Greta is They want you to advise them regarding making their IRA ie which option makes more sense under the facts?

Be prepared to answer questions regarding gross total income, AGI, taxable income, federal tax liability before any credits and additional tax due to the IRS or refund due back to the taxpayers. You should include any relevant credits that we covered to which the taxpayers are entitled based on the facts. Did the taxpayers make their contribution to a traditional IRA or a Roth IRA?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock