Question: During 2 0 2 4 , your clients, Mr . and Mrs . Howell, owned the following investment assets: * No commissions are charged when

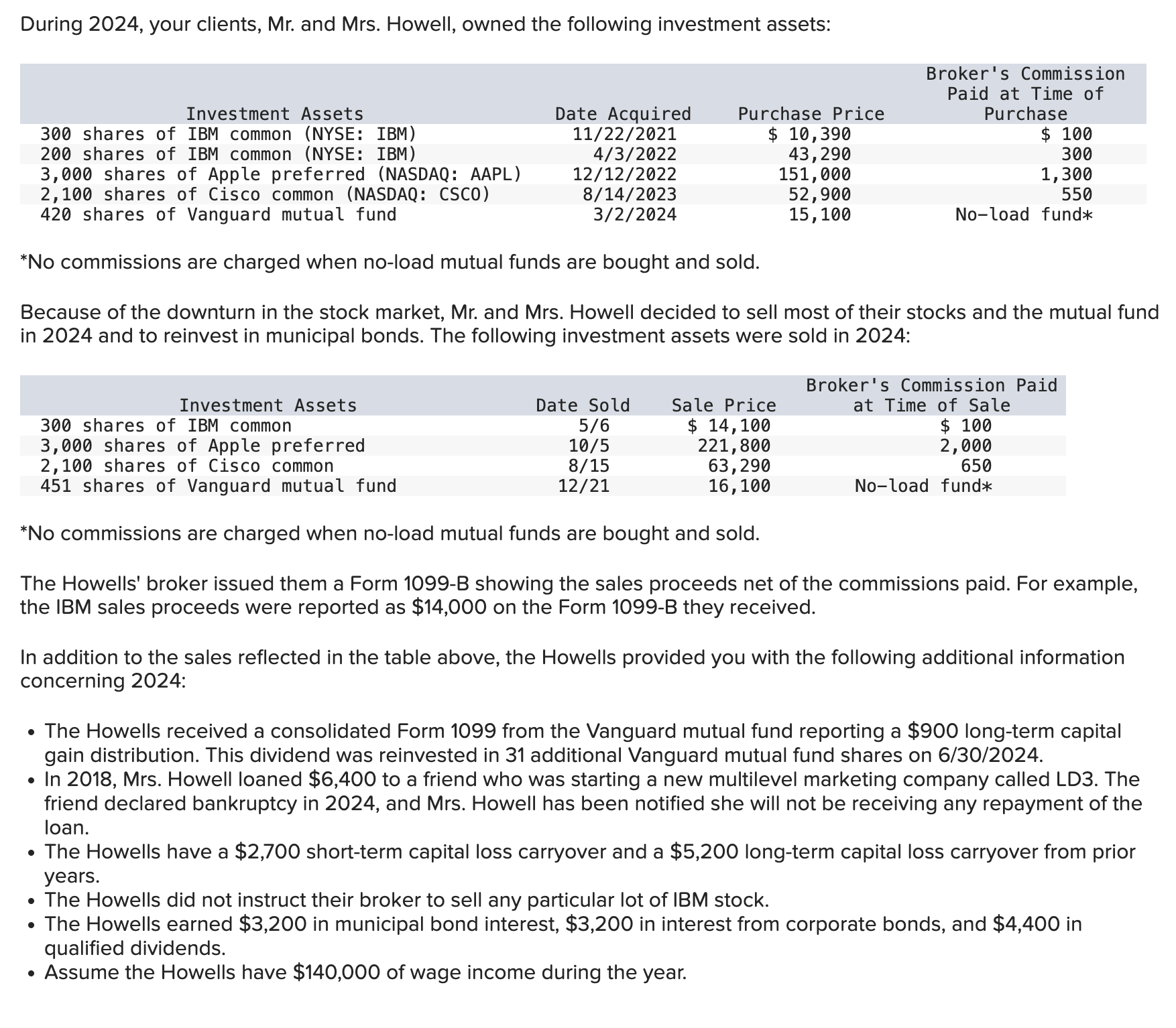

During your clients, Mr and Mrs Howell, owned the following investment assets:

No commissions are charged when noload mutual funds are bought and sold.

Because of the downturn in the stock market, Mr and Mrs Howell decided to sell most of their stocks and the mutual fund

in and to reinvest in municipal bonds. The following investment assets were sold in :

No commissions are charged when noload mutual funds are bought and sold.

The Howells' broker issued them a Form B showing the sales proceeds net of the commissions paid. For example,

the IBM sales proceeds were reported as $ on the Form B they received.

In addition to the sales reflected in the table above, the Howells provided you with the following additional information

concerning :

The Howells received a consolidated Form from the Vanguard mutual fund reporting a $ longterm capital

gain distribution. This dividend was reinvested in additional Vanguard mutual fund shares on

In Mrs Howell loaned $ to a friend who was starting a new multilevel marketing company called LD The

friend declared bankruptcy in and Mrs Howell has been notified she will not be receiving any repayment of the

Ioan.

The Howells have a $ shortterm capital loss carryover and a $ longterm capital loss carryover from prior

years.

The Howells did not instruct their broker to sell any particular lot of IBM stock.

The Howells earned $ in municipal bond interest, $ in interest from corporate bonds, and $ in

qualified dividends.

Assume the Howells have $ of wage income during the year.

c Assume the Howells' shortterm capital loss carryover from prior years is $ rather than $ as indicated above. If this is the case, how much shortterm and longterm capital loss carryovers remain to be carried beyond to future tax years?

Short Term Capital Loss

Long Term Capital Loss

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock