Question: During 2014, ABC installed a production assembly line In 2015, ABC purchased a new machine and rearranged the assembly line to install this machine The

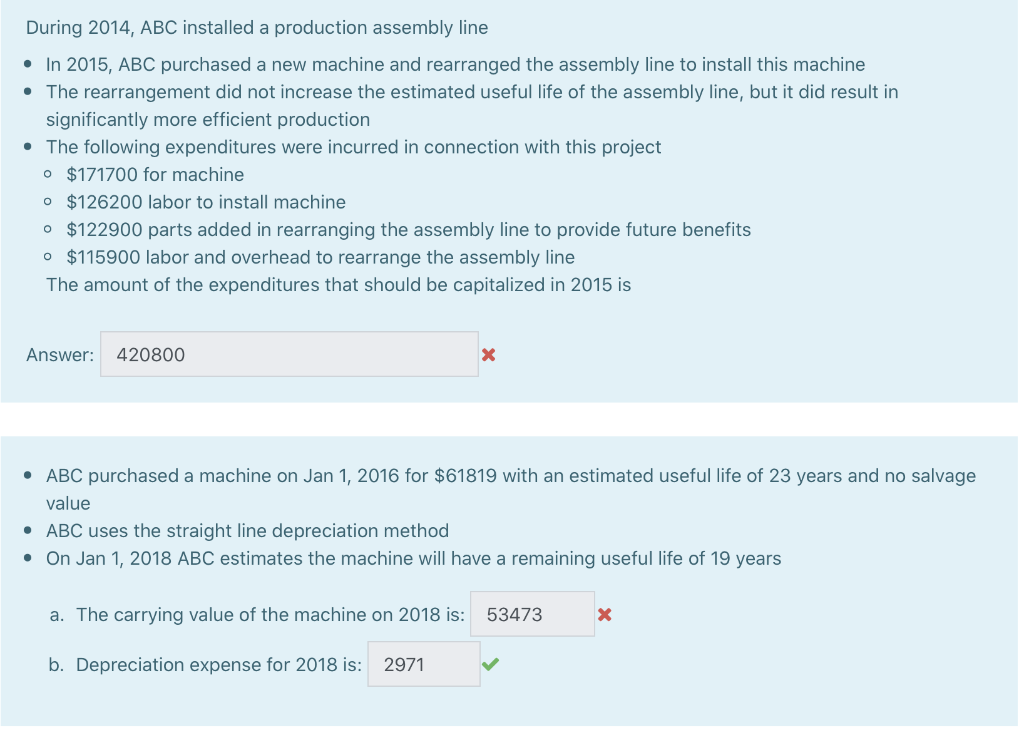

During 2014, ABC installed a production assembly line In 2015, ABC purchased a new machine and rearranged the assembly line to install this machine The rearrangement did not increase the estimated useful life of the assembly line, but it did result in significantly more efficient production The following expenditures were incurred in connection with this project o $171700 for machine $126200 labor to install machine o $122900 parts added in rearranging the assembly line to provide future benefits o $115900 labor and overhead to rearrange the assembly line The amount of the expenditures that should be capitalized in 2015 is Answer: 420800 ABC purchased a machine on Jan 1, 2016 for $61819 with an estimated useful life of 23 years and no salvage value ABC uses the straight line depreciation method On Jan 1, 2018 ABC estimates the machine will have a remaining useful life of 19 years a. The carrying value of the machine on 2018 is: 53473 b. Depreciation expense for 2018 is: 2971

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts