Question: During 2017, Drew was feeling very generous as evidenced by the following events: .On January 10, 2017, Drew gave his son a house that Drew

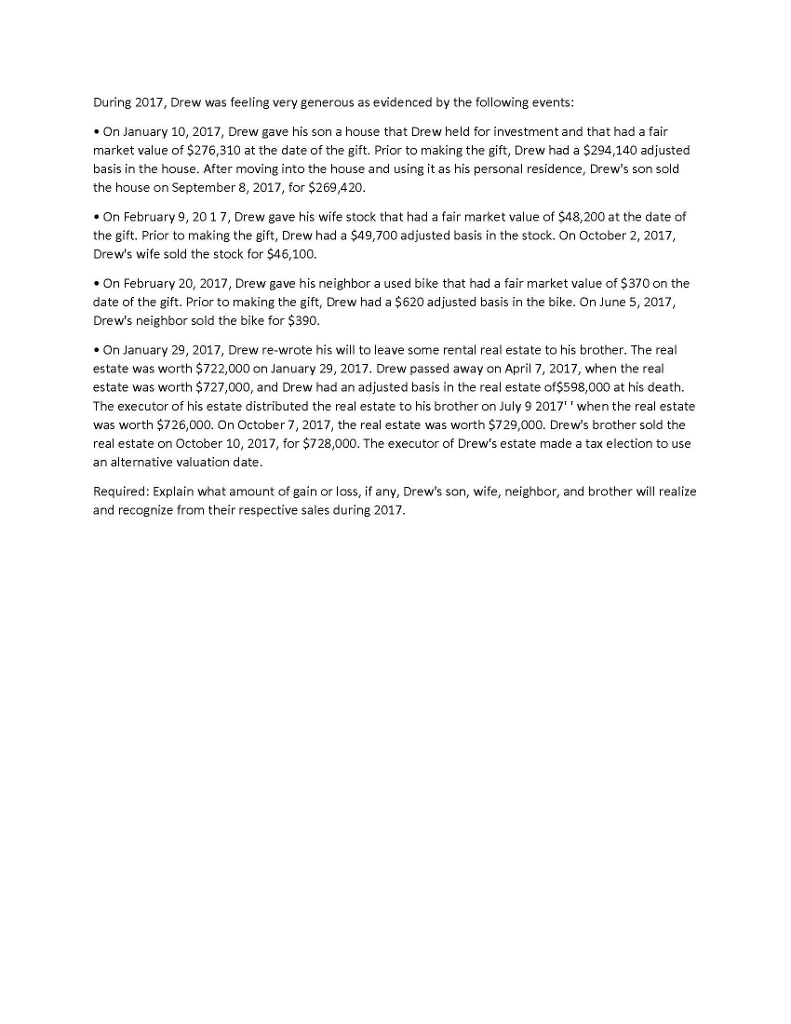

During 2017, Drew was feeling very generous as evidenced by the following events: .On January 10, 2017, Drew gave his son a house that Drew held for investment and that had a fair market value of $276,310 at the date of the gift. Prior to making the gift, Drew had a $294,140 adjusted basis in the house. After moving into the house and using it as his personal residence, Drew's son sold the house on September 8, 2017, for $269,420 .On February 9, 20 17, Drew gave his wife stock that had a fair market value of $48,200 at the date of the gift. Prior to making the gift, Drew had a $49,700 adjusted basis in the stock. On October 2, 2017, Drew's wife sold the stock for $46,100. .On February 20, 2017, Drew gave his neighbor a used bike that had a fair market value of $370 on the date of the gift. Prior to making the gift, Drew had a $620 adjusted basis in the bike. On June 5, 2017, Drew's neighbor sold the bike for $390 . On January 29, 2017, Drew re-wrote his will to leave some rental real estate to his brother. The real estate was worth $722,000 on January 29, 2017. Drew passed away on April 7, 2017, when the real estate was worth $727,000, and Drew had an adjusted basis in the real estate of$598,000 at his death. The executor of his estate distributed the real estate to his brother on July 9 2017 " when the real estate was worth $726,000. On October 7, 2017, the real estate was worth $729,000. Drew's brother sold the real estate on October 10, 2017, for $728,000. The executor of Drew's estate made a tax election to use an alternative valuation date Required: Explain what amount of gain or loss, if any, Drew's son, wife, neighbor, and brother will realize and recognize from their respective sales during 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts