Question: During its first year of operations, Sive.com reported a net operating loss of $24 million for financial reporting and tax purposes. The enacted tax rate

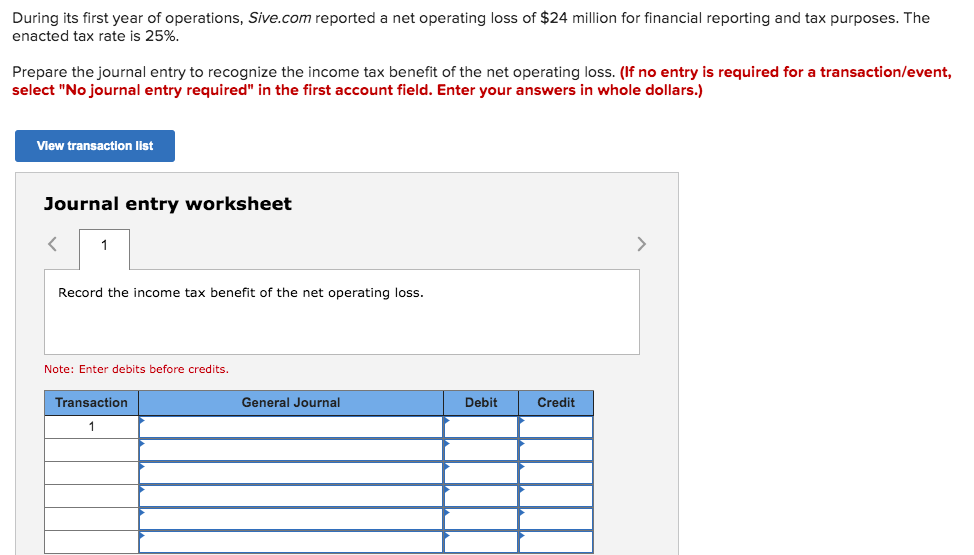

During its first year of operations, Sive.com reported a net operating loss of $24 million for financial reporting and tax purposes. The enacted tax rate is 25%. Prepare the journal entry to recognize the income tax benefit of the net operating loss. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet Record the income tax benefit of the net operating loss. Note: Enter debits before credits. Transaction General Journal Debit Credit 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts