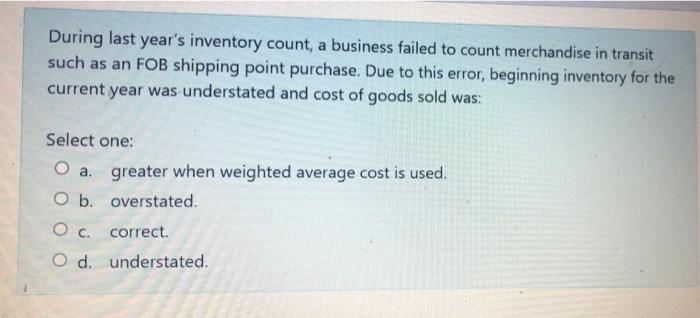

Question: During last year's inventory count, a business failed to count merchandise in transit such as an FOB shipping point purchase. Due to this error, beginning

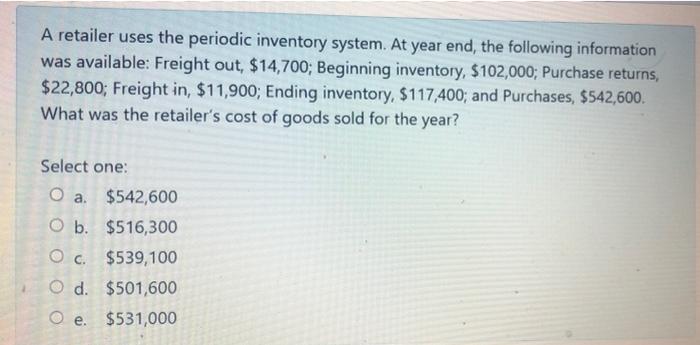

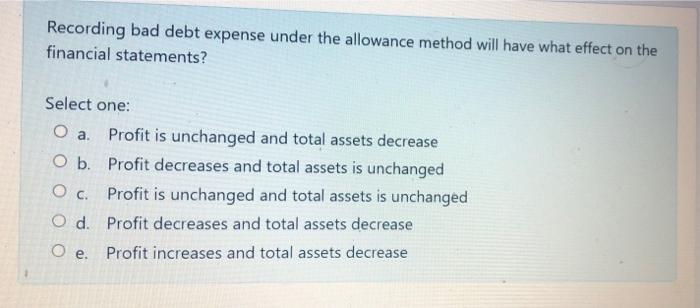

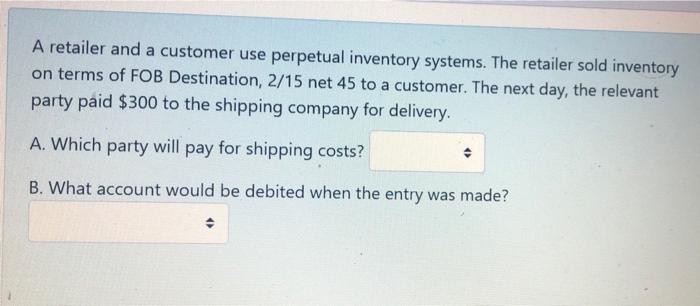

During last year's inventory count, a business failed to count merchandise in transit such as an FOB shipping point purchase. Due to this error, beginning inventory for the current year was understated and cost of goods sold was: Select one: O a greater when weighted average cost is used. O b. overstated. Oc. correct. Od understated. A retailer uses the periodic inventory system. At year end, the following information was available: Freight out, $14,700; Beginning inventory, $102,000; Purchase returns, $22,800; Freight in, $11,900; Ending inventory, $117,400; and Purchases, $542,600. What was the retailer's cost of goods sold for the year? O a Select one: $542,600 O b. $516,300 Oc. $539,100 O d. $501,600 O e. $531,000 Recording bad debt expense under the allowance method will have what effect on the financial statements? Select one: O a. Profit is unchanged and total assets decrease O b. Profit decreases and total assets is unchanged Oc. Profit is unchanged and total assets is unchanged O d. Profit decreases and total assets decrease Profit increases and total assets decrease O. A retailer and a customer use perpetual inventory systems. The retailer sold inventory on terms of FOB Destination, 2/15 net 45 to a customer. The next day, the relevant party paid $300 to the shipping company for delivery. A. Which party will pay for shipping costs? B. What account would be debited when the entry was made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts