Question: During the 2 0 2 1 / 2 2 tax year, Porter Chrystan created the Blind Trust, an inter vivos trust to provide services to

During the tax year, Porter Chrystan created the Blind Trust, an inter vivos trust to provide services to his psychiatry practice. The net income of the trust for the tax year was $

The trust is to be distributed as follows:

Josh aged

Marise aged

Scott aged

Barnaby aged

The balance is to be accumulated and applied at the trustee's discretion for the beneficiaries.

There were two discretionary distributions made:

$ was paid towards Barnaby's education.

$ was paid to Ford Credit to pay off a debt incurred by Scott who is currently under medical supervision as he has been pronounced insane.

Barnaby worked at Hillbilly Pizza for hours per week and derived gross wages of $PAYG tax withheld $ during the year. He also received income of $ from a deceased estate including franking credits of $

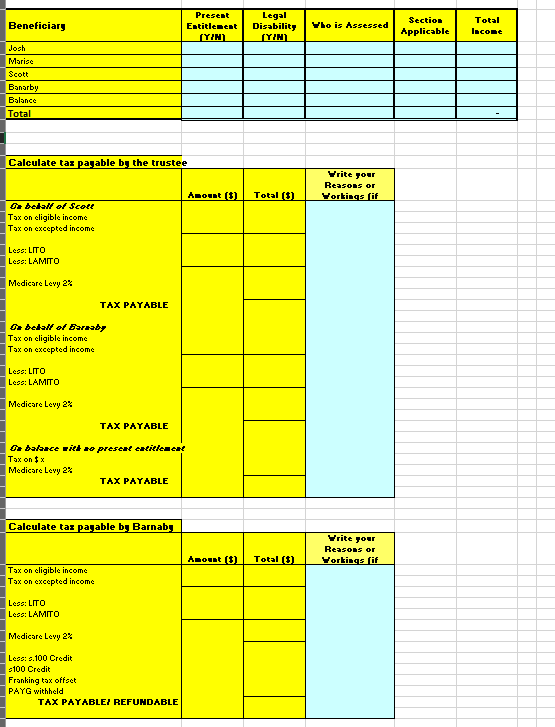

Prepare a schedule covering all beneficiaries nominating:

Name of the BENEFICIARY

Whether or not the beneficiary is PRESENTLY ENTITLED

Whether or not the beneficiary is under a LEGAL DISABILITY

Which SECTIONS of the Act apply to make the income assessable

WHO IS ASSESSED on each amount

The AMOUNT retained or distributed Calculate tax payable by the trustee.

Calculate tax payable by Barnaby.

This is for Australian tax ratesCalculate tax payable by the trustee

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock