Question: During the adjusting process two transactions were neglected or omitted. The first is for unearned rent revenue of which $415 was earned during the period,

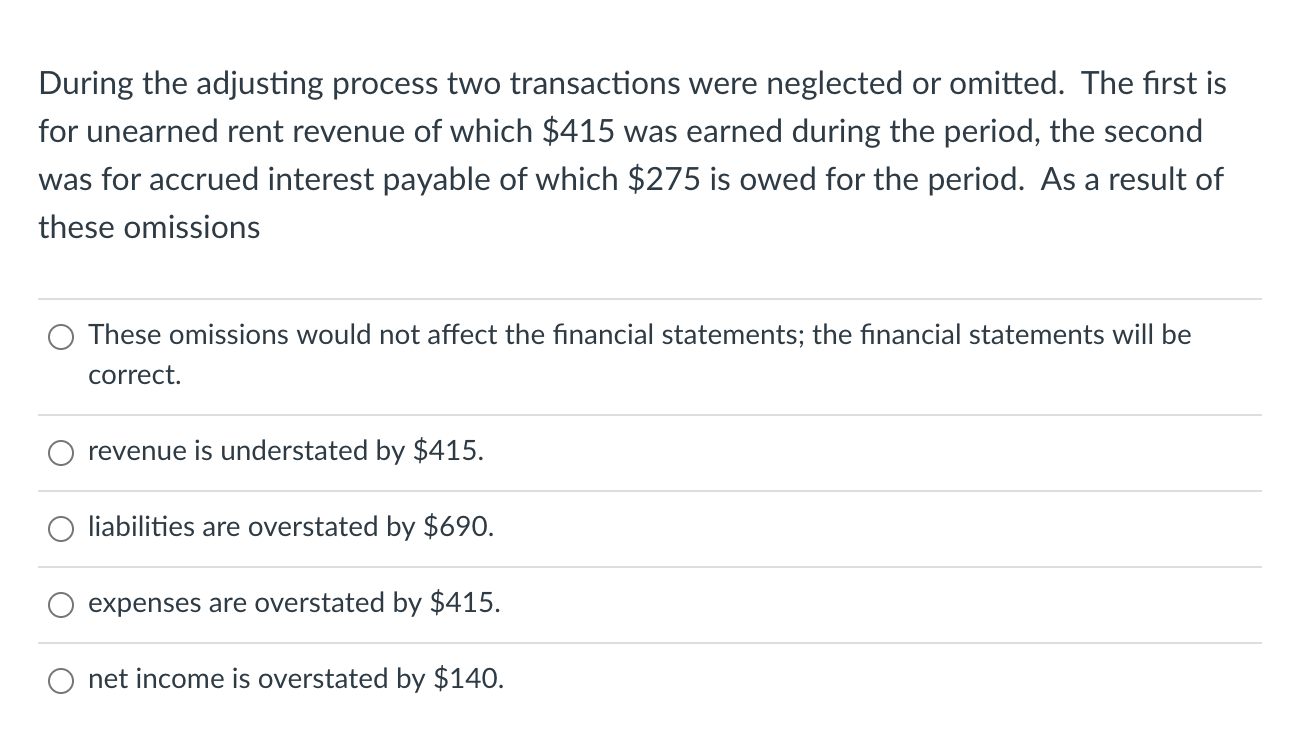

During the adjusting process two transactions were neglected or omitted. The first is for unearned rent revenue of which $415 was earned during the period, the second was for accrued interest payable of which $275 is owed for the period. As a result of these omissions

During the adjusting process two transactions were neglected or omitted. The first is for unearned rent revenue of which $415 was earned during the period, the second was for accrued interest payable of which $275 is owed for the period. As a result of these omissions These omissions would not affect the financial statements; the financial statements will be correct. revenue is understated by $415. O liabilities are overstated by $690. expenses are overstated by $415. net income is overstated by $140

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts