Question: During the current fiscal year, Crane Corp. signed a long-term noncancellable purchase commitment with its primary supplier. Crane agreed to purchase $2.22 million of raw

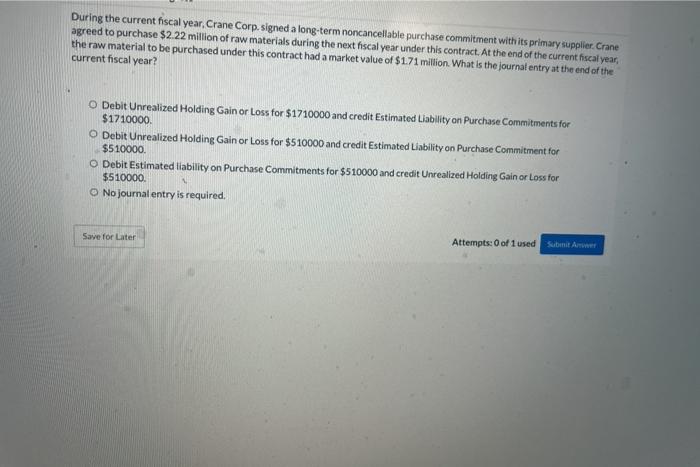

During the current fiscal year, Crane Corp. signed a long-term noncancellable purchase commitment with its primary supplier. Crane agreed to purchase $2.22 million of raw materials during the next fiscal year under this contract. At the end of the current fiscal year, the raw material to be purchased under this contract had a market value of $1.71 million. What is the journal entry at the end of the current fiscal year? O Debit Unrealized Holding Gain or Loss for $1710000 and credit Estimated Liability on Purchase Commitments for $1710000 O Debit Unrealized Holding Gain or Loss for $510000 and credit Estimated Liability on Purchase Commitment for $510000 O Debit Estimated liability on Purchase Commitments for $510000 and credit Unrealized Holding Gain or Loss for $510000. O No journal entry is required. Save for Later Attempts: 0 of 1 used Sibmit Anwer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts