Question: During the current year, Ben worked 1,500 hours as a tax consultant and 500 hours as a real estate agent. His one other employee (his

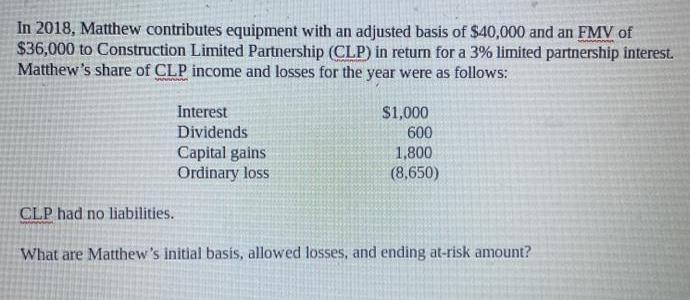

In 2018, Matthew contributes equipment with an adjusted basis of $40,000 and an FMV of $36,000 to Construction Limited Partnership (CLP) in return for a 3% limited partnership interest. Matthew's share of CLP income and losses for the year were as follows: Interest Dividends Capital gains Ordinary loss $1,000 600 1,800 (8,650) CLP had no liabilities. What are Matthew's initial basis, allowed losses, and ending at-risk amount?

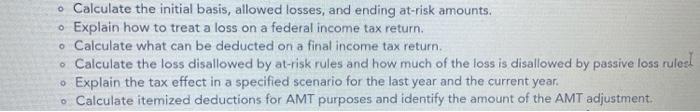

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Matthews Initial Basis Matthews initial basis in the limited partnership interest is determined by the adjusted basis of the contributed equipment In this case the adjusted basis is 40000 Therefore Ma... View full answer

Get step-by-step solutions from verified subject matter experts