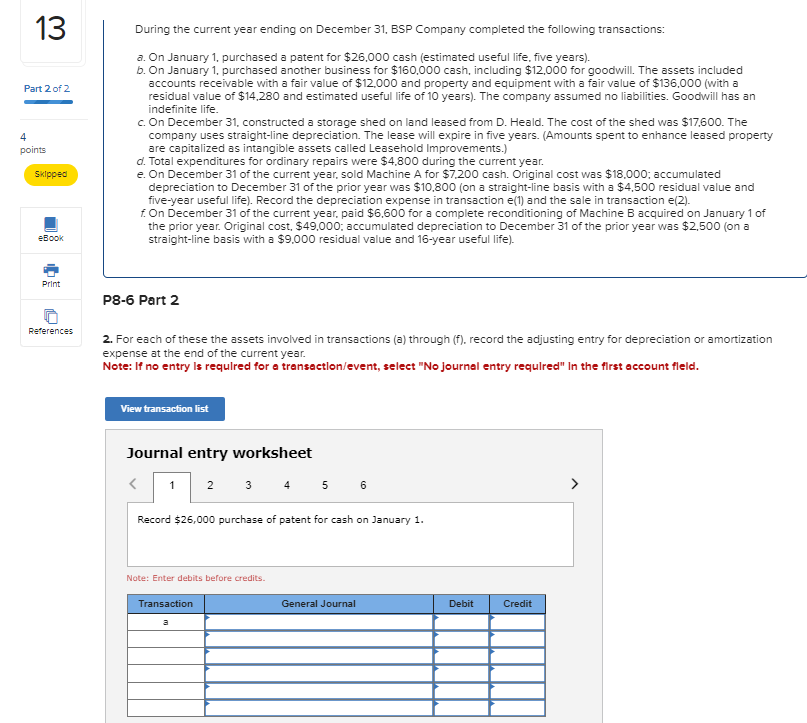

Question: During the current year ending on December 3 1 , BSP Company completed the following transactions: a . On January 1 , purchased a patent

During the current year ending on December BSP Company completed the following transactions:

a On January purchased a patent for $ cash estimated useful life, five years

b On January purchased another business for $ cash, including $ for goodwill. The assets included

accounts receivable with a fair value of $ and property and equipment with a fair value of $with a

residual value of $ and estimated useful life of years The company assumed no liabilities. Goodwill has an

indefinite life.

c On December constructed a storage shed on land leased from D Heald. The cost of the shed was $ The

company uses straightline depreciation. The lease will expire in five years. Amounts spent to enhance leased property

are capitalized as intangible assets called Leasehold Improvements.

d Total expenditures for ordinary repairs were $ during the current year.

e On December of the current year, sold Machine A for $ cash. Original cost was $; accumulated

depreciation to December of the prior year was $on a straightline basis with a $ residual value and

fiveyear useful life Record the depreciation expense in transaction e and the sale in transaction e

On December of the current year, paid $ for a complete reconditioning of Machine acquired on January of

the prior year. Original cost, $; accumulated depreciation to December of the prior year was $on a

straightline basis with a $ residual value and year useful life

P Part

For each of these the assets involved in transactions a through record the adjusting entry for depreciation or amortization

expense at the end of the current year.

Note: If no entry ls requlred for a transactlonevent select No journal entry requlred" In the flrst account fleld.

Journal entry worksheet

Record $ purchase of patent for cash on January

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock