Question: During the current year, Henry's office building is destroyed by fire. After collecting the insurance proceeds, Henry has a $46,000 recognized gain. The building was

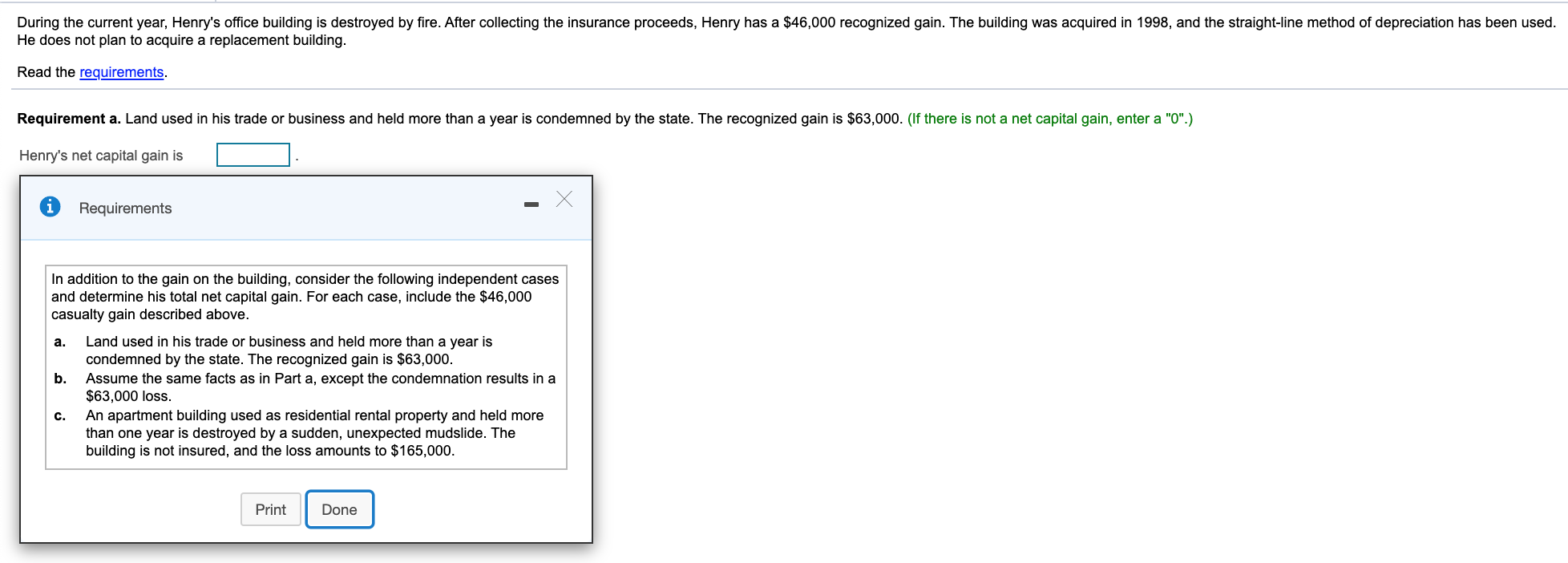

During the current year, Henry's office building is destroyed by fire. After collecting the insurance proceeds, Henry has a $46,000 recognized gain. The building was acquired in 1998, and the straight-line method of depreciation has been used. He does not plan to acquire a replacement building. Read the requirements. Requirement a. Land used in his trade or business and held more than a year is condemned by the state. The recognized gain is $63,000. (If there is not a net capital gain, enter a "0".) Henry's net capital gain is Requirements a. In addition to the gain on the building, consider the following independent cases and determine his total net capital gain. For each case, include the $46,000 casualty gain described above. Land used in his trade or business and held more than a year is condemned by the state. The recognized gain is $63,000. b. Assume the same facts as in Part a, except the condemnation results in a $63,000 loss. An apartment building used as residential rental property and held more than one year is destroyed by a sudden, unexpected mudslide. The building is not insured, and the loss amounts to $165,000. C. Print Done During the current year, Henry's office building is destroyed by fire. After collecting the insurance proceeds, Henry has a $46,000 recognized gain. The building was acquired in 1998, and the straight-line method of depreciation has been used. He does not plan to acquire a replacement building. Read the requirements. Requirement a. Land used in his trade or business and held more than a year is condemned by the state. The recognized gain is $63,000. (If there is not a net capital gain, enter a "0".) Henry's net capital gain is Requirements a. In addition to the gain on the building, consider the following independent cases and determine his total net capital gain. For each case, include the $46,000 casualty gain described above. Land used in his trade or business and held more than a year is condemned by the state. The recognized gain is $63,000. b. Assume the same facts as in Part a, except the condemnation results in a $63,000 loss. An apartment building used as residential rental property and held more than one year is destroyed by a sudden, unexpected mudslide. The building is not insured, and the loss amounts to $165,000. C. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts