Question: During the current year, Tammy purchases a beachfront condominium for $675,000, paying $100,000 down and taking out a $575,000 mortgage, secured by the property. At

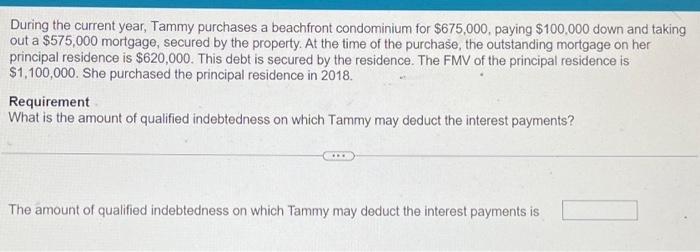

During the current year, Tammy purchases a beachfront condominium for $675,000, paying $100,000 down and taking out a $575,000 mortgage, secured by the property. At the time of the purchase, the outstanding mortgage on her principal residence is $620,000. This debt is secured by the residence. The FMV of the principal residence is $1,100,000. She purchased the principal residence in 2018. Requirement What is the amount of qualified indebtedness on which Tammy may deduct the interest payments

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock