Question: 'During the last few years, Thuggie Jackboote Co. has been too constrained by its high cost of capital to make many capital investments. Recently, however,

'During the last few years, Thuggie Jackboote Co. has been too constrained by its high cost of capital to make many capital investments. Recently, however, capital costs have been declining, and the company has decided to look seriously at a major expansion program that has been proposed by the marketing department. You are an assistant to the financial VP, given the task of revisiting the issue. Using the information below, estimate the company's cost of capital and answer the questions posed. Input your solutions in the respective green boxes. Be sure to use Excel to make all calculations. Avoid the entry of any computations. Use columns I - O to add any notes or show work if needed.

Questions

#1 What is the company's before-tax cost of debt? #2 Based the information available, if these bonds were callable, would you expect the bonds to be called? Explain why or why not. #3 What is the company's cost of preferred stock? #4 Estimate the company's cost of common stock using three (3) different methods. CAPM, DCF, Bond yield+Risk premium #5 Calculate the company's WACC. #6 Based on your results above, describe the projects that the company should pursue if you assume that all projects are similar to past projects and are considered to be equally risky.

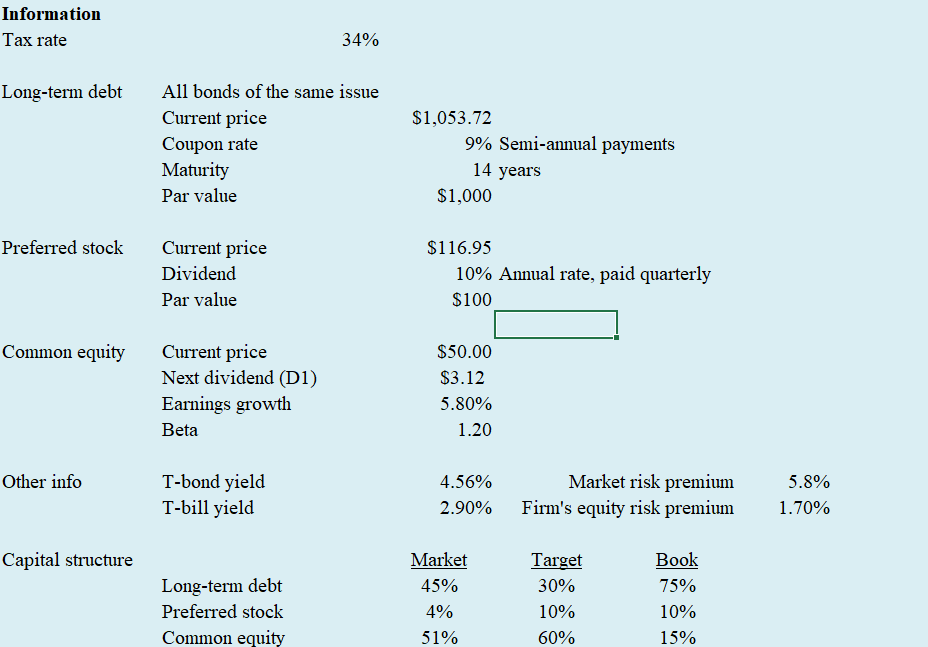

Information Tax rate 34% Long-term debt All bonds of the same issue Current price Coupon rate Maturity Par value $1,053.72 9% Semi-annual payments 14 years $1,000 Preferred stock Current price Dividend $116.95 10% Annual rate, paid quarterly $100 Par value Common equity $50.00 $3.12 Current price Next dividend (D1) Earnings growth Beta 5.80% 1.20 Other info 4.56% 5.8% T-bond yield T-bill yield Market risk premium Firm's equity risk premium 2.90% 1.70% Capital structure Market Target 30% Book 75% Long-term debt 45% Preferred stock 4% 10% 10% Common equity 51% 60% 15% Information Tax rate 34% Long-term debt All bonds of the same issue Current price Coupon rate Maturity Par value $1,053.72 9% Semi-annual payments 14 years $1,000 Preferred stock Current price Dividend $116.95 10% Annual rate, paid quarterly $100 Par value Common equity $50.00 $3.12 Current price Next dividend (D1) Earnings growth Beta 5.80% 1.20 Other info 4.56% 5.8% T-bond yield T-bill yield Market risk premium Firm's equity risk premium 2.90% 1.70% Capital structure Market Target 30% Book 75% Long-term debt 45% Preferred stock 4% 10% 10% Common equity 51% 60% 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts