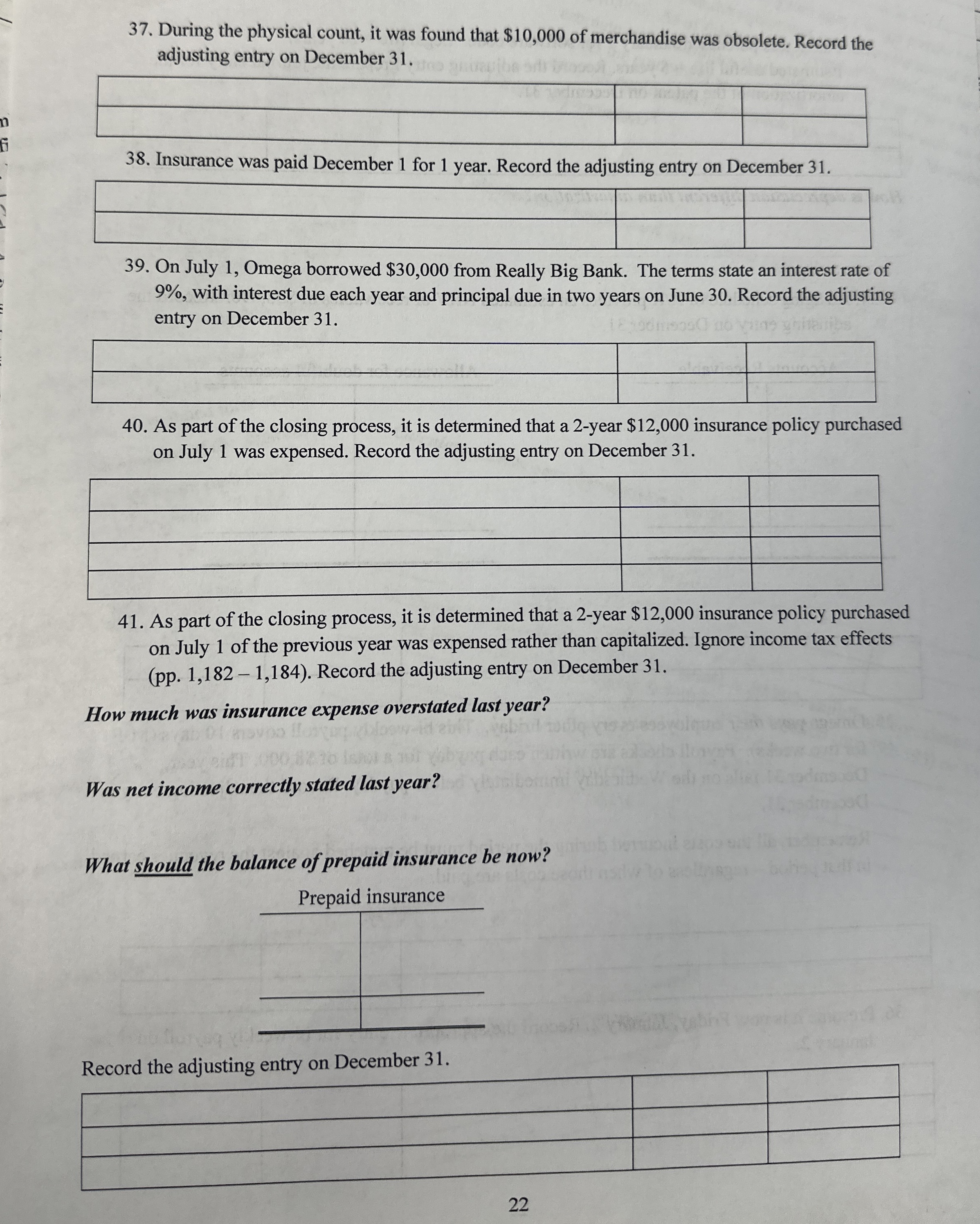

Question: During the physical count, it was found that $ 1 0 , 0 0 0 of merchandise was obsolete. Record the adjusting entry on December

During the physical count, it was found that $ of merchandise was obsolete. Record the

adjusting entry on December

Insurance was paid December for year. Record the adjusting entry on December

On July Omega borrowed $ from Really Big Bank. The terms state an interest rate of

with interest due each year and principal due in two years on June Record the adjusting

entry on December

As part of the closing process, it is determined that a year $ insurance policy purchased

on July was expensed. Record the adjusting entry on December

As part of the closing process, it is determined that a year $ insurance policy purchased

on July of the previous year was expensed rather than capitalized. Ignore income tax effects

pp Record the adjusting entry on December

How much was insurance expense overstated last year?

Was net income correctly stated last year?

What should the balance of prepaid insurance be now?

Record the adjusting entry on December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock