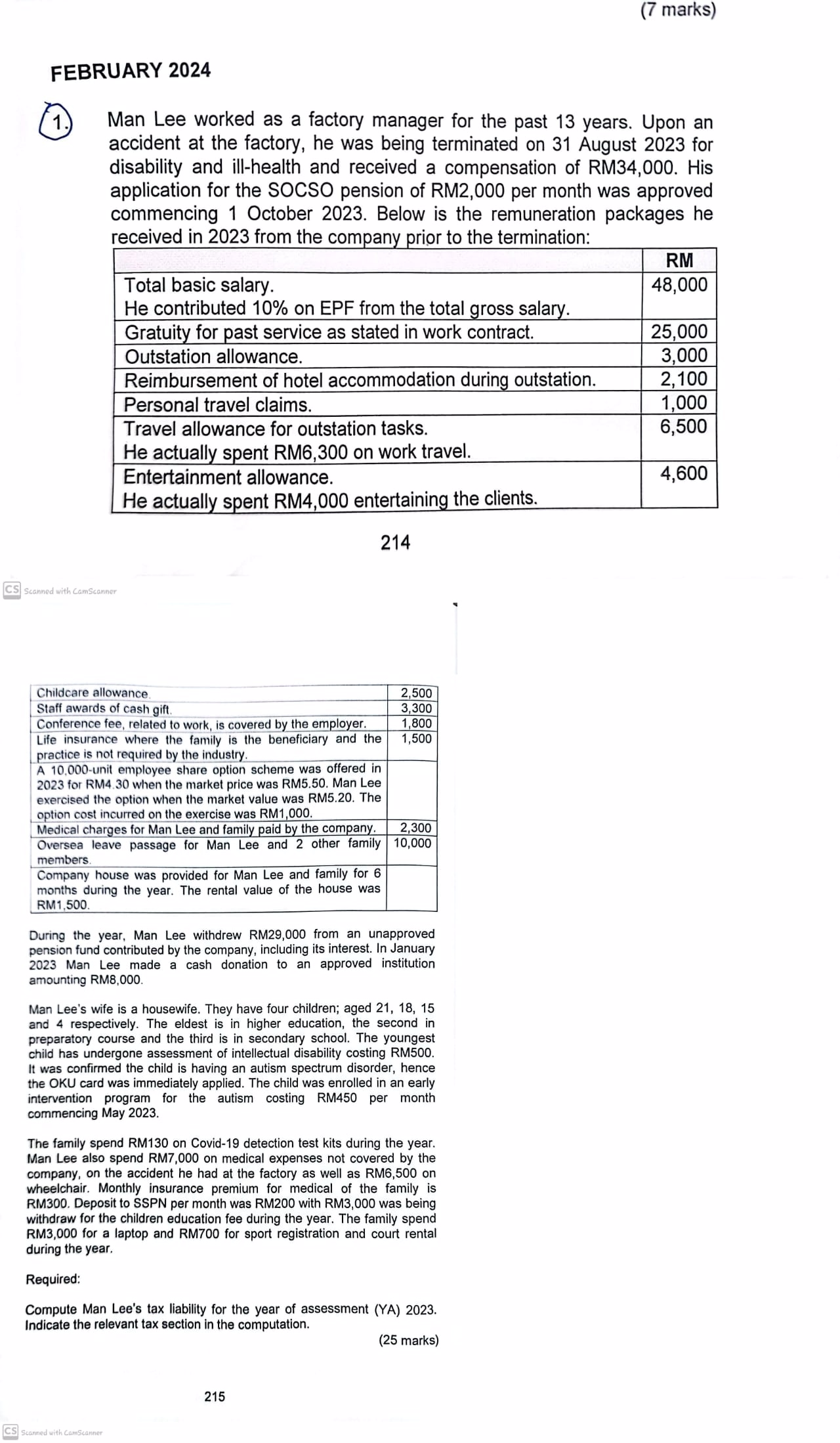

Question: During the year, Man Lee withdrew RM 2 9 , 0 0 0 from an unapproved pension fund contributed by the company, including its interest.

During the year, Man Lee withdrew RM from an unapproved pension fund contributed by the company, including its interest. In January Man Lee made a cash donation to an approved institution amounting RM

Man Lee's wife is a housewife. They have four children; aged and respectively. The eldest is in higher education, the second in preparatory course and the third is in secondary school. The youngest child has undergone assessment of intellectual disability costing RM It was confirmed the child is having an autism spectrum disorder, hence the OKU card was immediately applied. The child was enrolled in an early intervention program for the autism costing RM per month commencing May

The family spend RM on Covid detection test kits during the year. Man Lee also spend RM on medical expenses not covered by the company, on the accident he had at the factory as well as RM on wheelchair. Monthly insurance premium for medical of the family is RM Deposit to SSPN per month was RM with RM was being withdraw for the children education fee during the year. The family spend RM for a laptop and RM for sport registration and court rental during the year.

Required:

Compute Man Lee's tax liability for the year of assessment YA Indicate the relevant tax section in the computation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock