Question: During the year, Scott charged $ 4 , 0 0 0 on his credit card for his dependent son's medical expenses. Payment to the credit

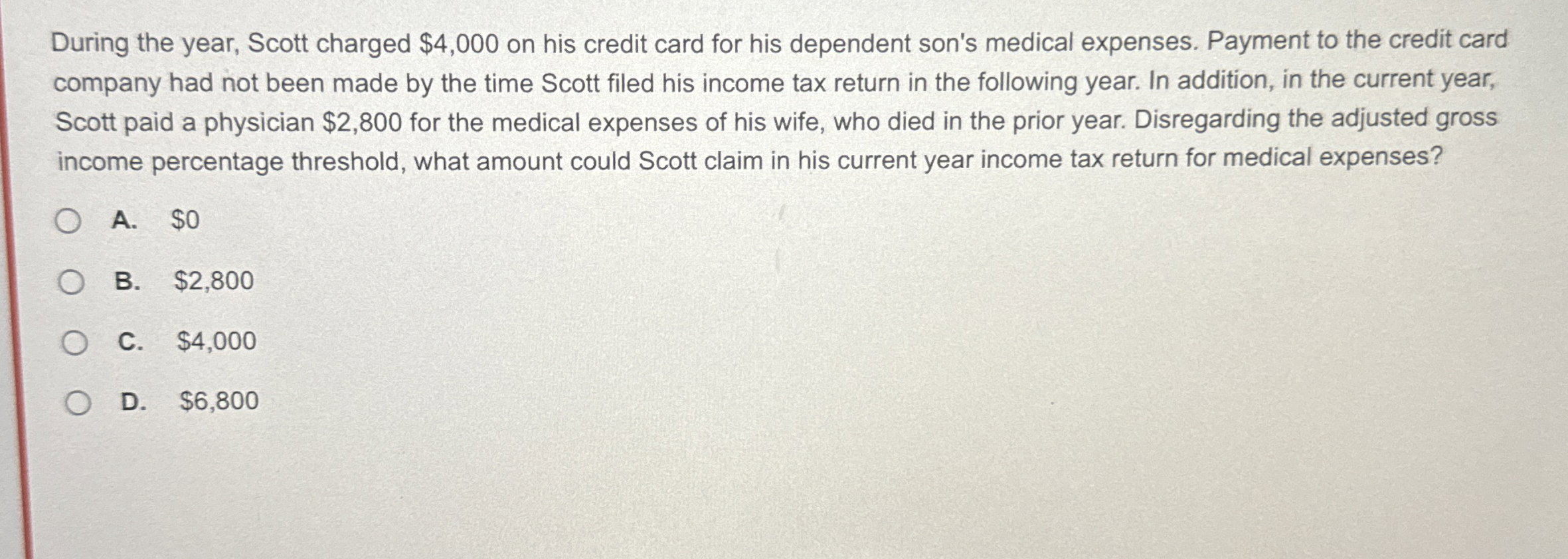

During the year, Scott charged $ on his credit card for his dependent son's medical expenses. Payment to the credit card

company had not been made by the time Scott filed his income tax return in the following year. In addition, in the current year,

Scott paid a physician $ for the medical expenses of his wife, who died in the prior year. Disregarding the adjusted gross

income percentage threshold, what amount could Scott claim in his current year income tax return for medical expenses?

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock