Question: During Year 1 and Year 2, Kale Co. completed the following transactions relating to its bond issue. The companys fiscal year ends on December 31.

During Year 1 and Year 2, Kale Co. completed the following transactions relating to its bond issue. The companys fiscal year ends on December 31.

Year 1

Mar.1 Issued $240,000 of 10 year, 5 percent bonds for $234,000. The semiannual cash payment for interest is due on March 1 and September 1, beginning September Year 1.

Sept.1 Recognized interest expense including the amortization of the discount and made the semiannual cash payment for interest.

Dec.31 Recognized accrued interest expense including the amortization of the discount.

Year 2

Mar.1 Recognized interest expense including the amortization of the discount and made the semiannual cash payment for interest.

Sept.1 Recognized interest expense including the amortization of the discount and made the semiannual cash payment for interest.

Dec.31 Recognized accrued interest expense including the amortization of the discount.

Required

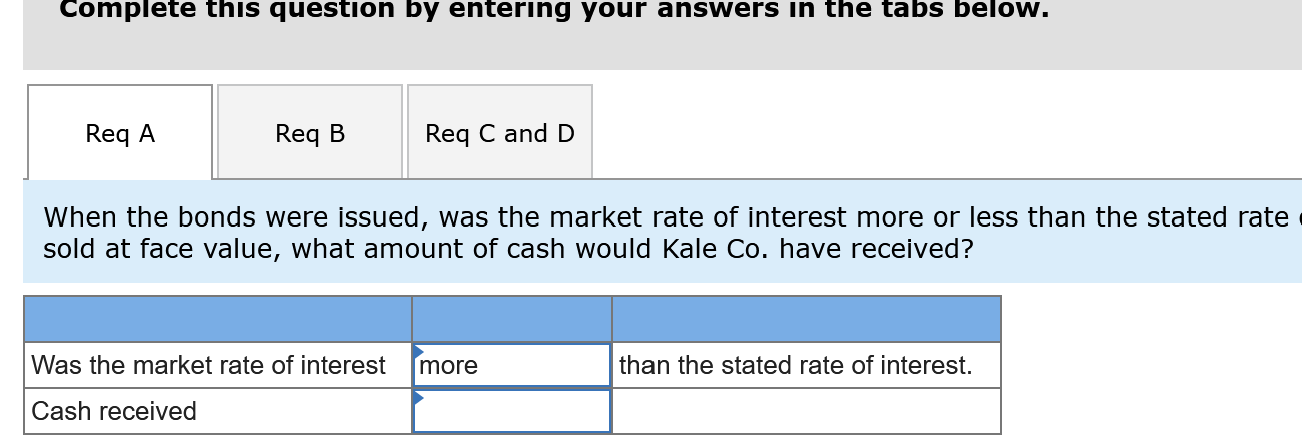

When the bonds were issued, was the market rate of interest more or less than the stated rate of interest? If the bonds had sold at face value, what amount of cash would Kale Co. have received?

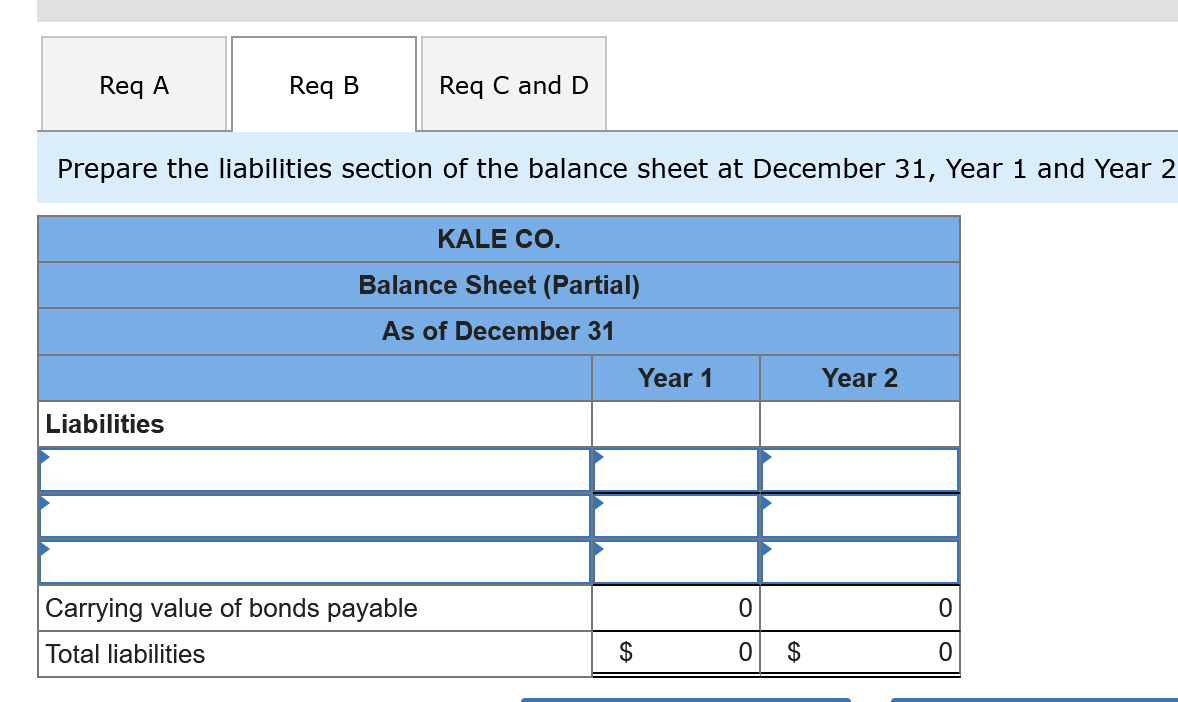

Prepare the liabilities section of the balance sheet at December 31, Year 1 and Year 2.

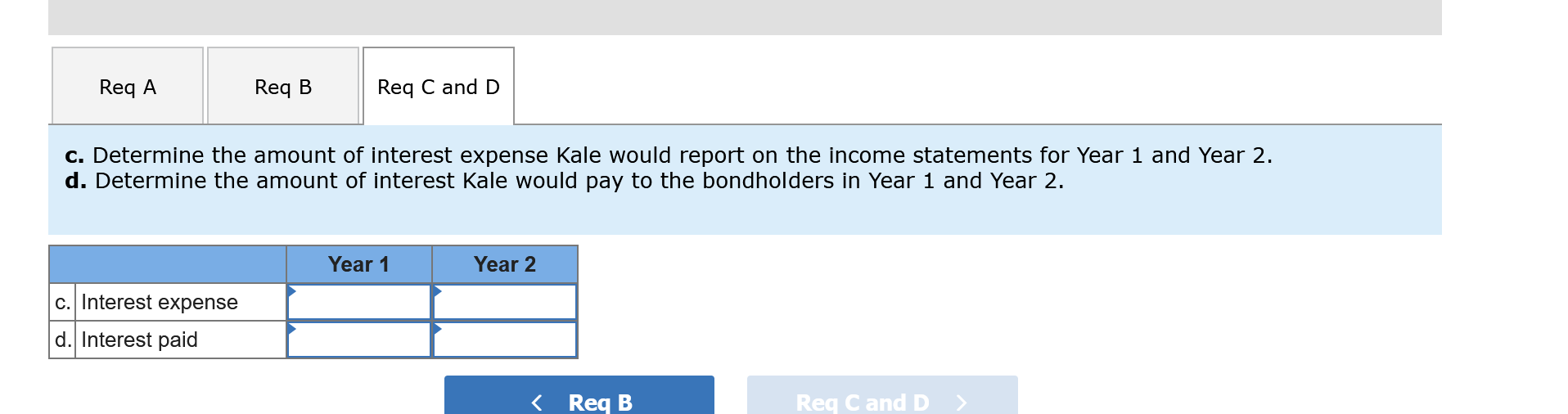

Determine the amount of interest expense Kale would report on the income statements for Year 1 and Year 2.

Determine the amount of interest Kale would pay to the bondholders in Year 1 and Year 2.

Req A Req B Liabilities Prepare the liabilities section of the balance sheet at December 31, Year 1 and Year 2 Req C and D KALE CO. Balance Sheet (Partial) As of December 31 Carrying value of bonds payable Total liabilities $ GA Year 1 0 0 $ Year 2 0 0 Complete this question by entering your answers in the tabs below. Req A Req B Req C and D When the bonds were issued, was the market rate of interest more or less than the stated rate sold at face value, what amount of cash would Kale Co. have received? Was the market rate of interest more Cash received than the stated rate of interest. Req A Req B c. Interest expense d. Interest paid Req C and D c. Determine the amount of interest expense Kale would report on the income statements for Year 1 and Year 2. d. Determine the amount of interest Kale would pay to the bondholders in Year 1 and Year 2. Year 1 Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts