Question: During Year 1 , Ashkar Company ordered a machine on January 1 at an invoice price of $ 2 1 , 0 0 0 .

During Year Ashkar Company ordered a machine on January at an invoice price of $ On the date of delivery, January the company paid $ on the machine, with the balance on credit at percent interest due in six months. On January it paid $ for freight on the machine. On January Ashkar paid installation costs relating to the machine amounting to $ On July the company paid the balance due on the machine plus the interest. On December the end of the accounting period Ashkar recorded depreciation on the machine using the straightline method with an estimated useful life of years and an estimated residual value of $

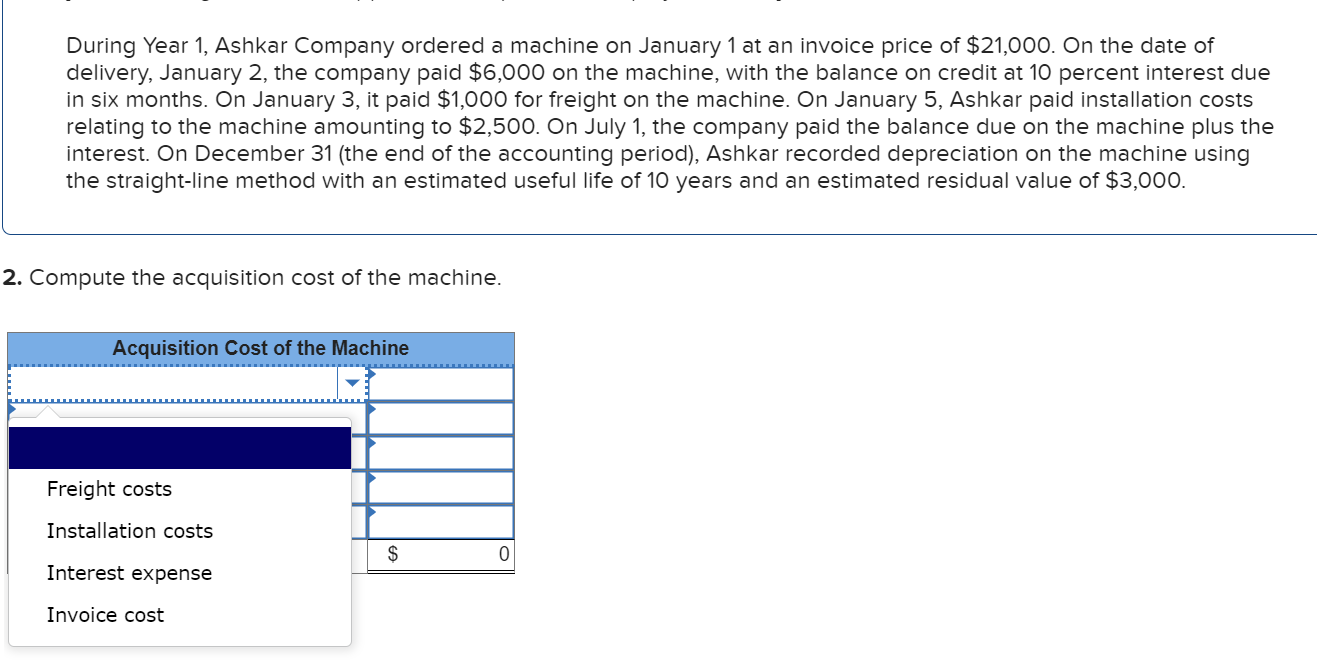

Compute the acquisition cost of the machine.During Year Ashkar Company ordered a machine on January at an invoice price of $ On the date of

delivery, January the company paid $ on the machine, with the balance on credit at percent interest due

in six months. On January it paid $ for freight on the machine. On January Ashkar paid installation costs

relating to the machine amounting to $ On July the company paid the balance due on the machine plus the

interest. On December the end of the accounting period Ashkar recorded depreciation on the machine using

the straightline method with an estimated useful life of years and an estimated residual value of $

Compute the acquisition cost of the machine.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock