Question: Dutton Animation Ltd., a Vancouver-based animation studio, has a December 31st year-end. At the beginning of the current year, the company's trial balance included the

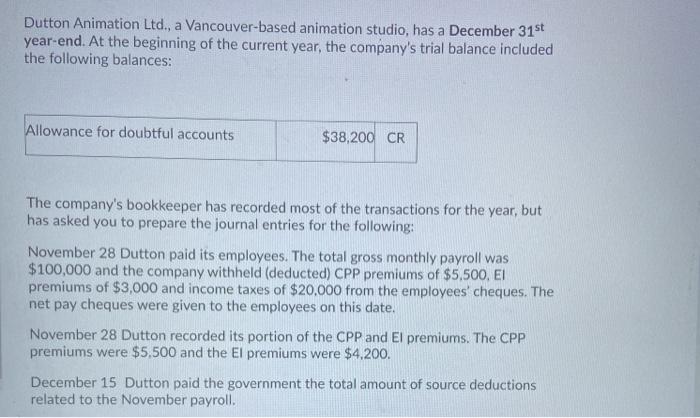

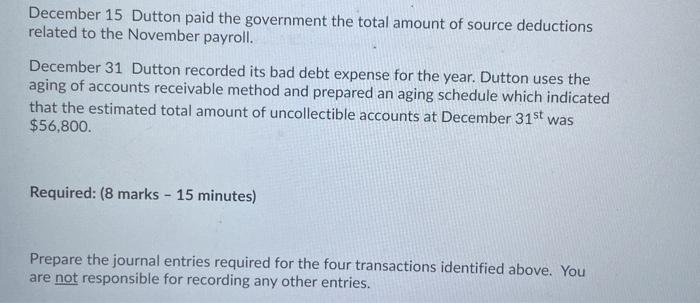

Dutton Animation Ltd., a Vancouver-based animation studio, has a December 31st year-end. At the beginning of the current year, the company's trial balance included the following balances: Allowance for doubtful accounts $38,200 CR The company's bookkeeper has recorded most of the transactions for the year, but has asked you to prepare the journal entries for the following: November 28 Dutton paid its employees. The total gross monthly payroll was $100,000 and the company withheld (deducted) CPP premiums of $5,500, EI premiums of $3,000 and income taxes of $20,000 from the employees' cheques. The net pay cheques were given to the employees on this date. November 28 Dutton recorded its portion of the CPP and El premiums. The CPP premiums were $5,500 and the El premiums were $4,200. December 15 Dutton paid the government the total amount of source deductions related to the November payroll. December 15 Dutton paid the government the total amount of source deductions related to the November payroll. December 31 Dutton recorded its bad debt expense for the year. Dutton uses the aging of accounts receivable method and prepared an aging schedule which indicated that the estimated total amount of uncollectible accounts at December 31st was $56,800. Required: (8 marks - 15 minutes) Prepare the journal entries required for the four transactions identified above. You are not responsible for recording any other entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts