Question: DVR Inc. can borrow dollars for five years at a coupon rate of 2.79 percent. Alternatively, it can borrow yen for five years at a

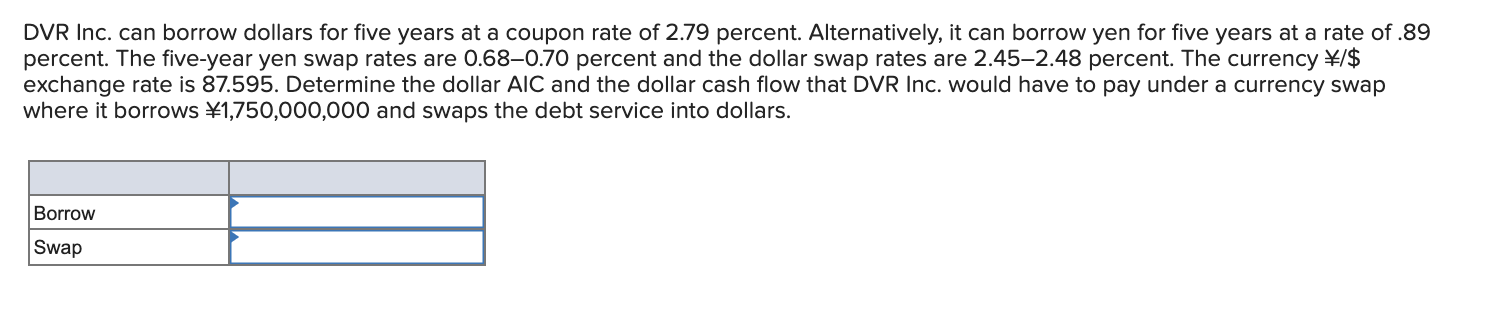

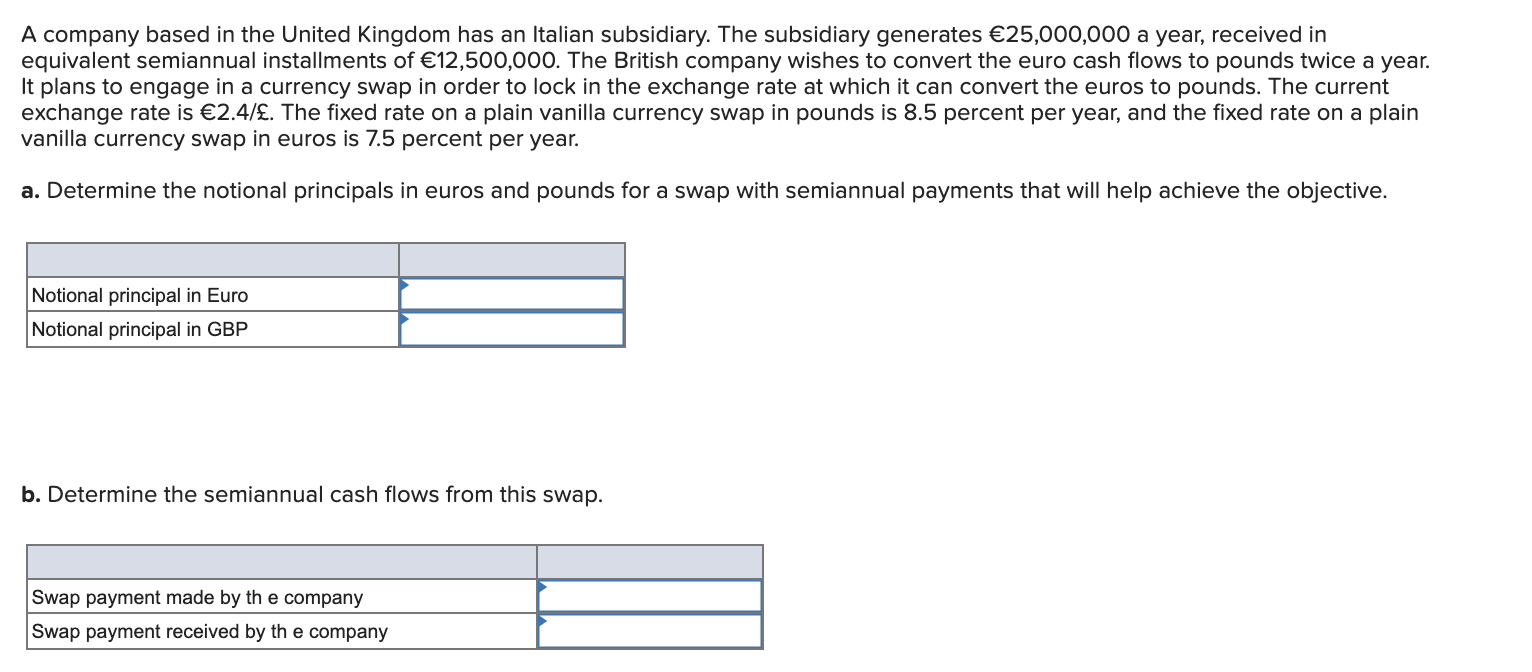

DVR Inc. can borrow dollars for five years at a coupon rate of 2.79 percent. Alternatively, it can borrow yen for five years at a rate of.89 percent. The five-year yen swap rates are 0.680.70 percent and the dollar swap rates are 2.452.48 percent. The currency \/$ exchange rate is 87.595. Determine the dollar AIC and the dollar cash flow that DVR Inc. would have to pay under a currency swap where it borrows $1,750,000,000 and swaps the debt service into dollars. Borrow Swap A company based in the United Kingdom has an Italian subsidiary. The subsidiary generates 25,000,000 a year, received in equivalent semiannual installments of 12,500,000. The British company wishes to convert the euro cash flows to pounds twice a year. It plans to engage in a currency swap in order to lock in the exchange rate at which it can convert the euros to pounds. The current exchange rate is 2.4/. The fixed rate on a plain vanilla currency swap in pounds is 8.5 percent per year, and the fixed rate on a plain vanilla currency swap in euros is 7.5 percent per year. a. Determine the notional principals in euros and pounds for a swap with semiannual payments that will help achieve the objective. Notional principal in Euro Notional principal in GBP b. Determine the semiannual cash flows from this swap. Swap payment made by the company Swap payment received by the company DVR Inc. can borrow dollars for five years at a coupon rate of 2.79 percent. Alternatively, it can borrow yen for five years at a rate of.89 percent. The five-year yen swap rates are 0.680.70 percent and the dollar swap rates are 2.452.48 percent. The currency \/$ exchange rate is 87.595. Determine the dollar AIC and the dollar cash flow that DVR Inc. would have to pay under a currency swap where it borrows $1,750,000,000 and swaps the debt service into dollars. Borrow Swap A company based in the United Kingdom has an Italian subsidiary. The subsidiary generates 25,000,000 a year, received in equivalent semiannual installments of 12,500,000. The British company wishes to convert the euro cash flows to pounds twice a year. It plans to engage in a currency swap in order to lock in the exchange rate at which it can convert the euros to pounds. The current exchange rate is 2.4/. The fixed rate on a plain vanilla currency swap in pounds is 8.5 percent per year, and the fixed rate on a plain vanilla currency swap in euros is 7.5 percent per year. a. Determine the notional principals in euros and pounds for a swap with semiannual payments that will help achieve the objective. Notional principal in Euro Notional principal in GBP b. Determine the semiannual cash flows from this swap. Swap payment made by the company Swap payment received by the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts