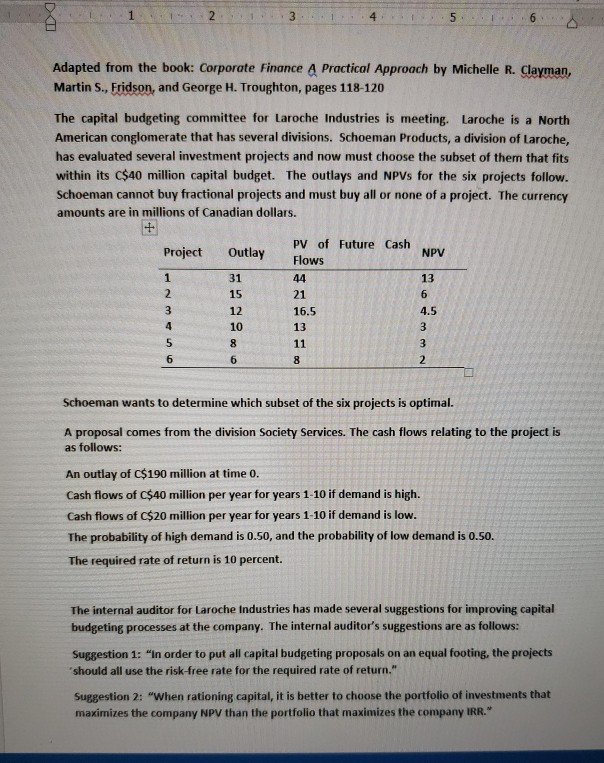

Question: DX 1 2 3 5 6 Adapted from the book: Corporate Finance A Practical Approach by Michelle R. Clayman, Martin S., Fridson, and George H.

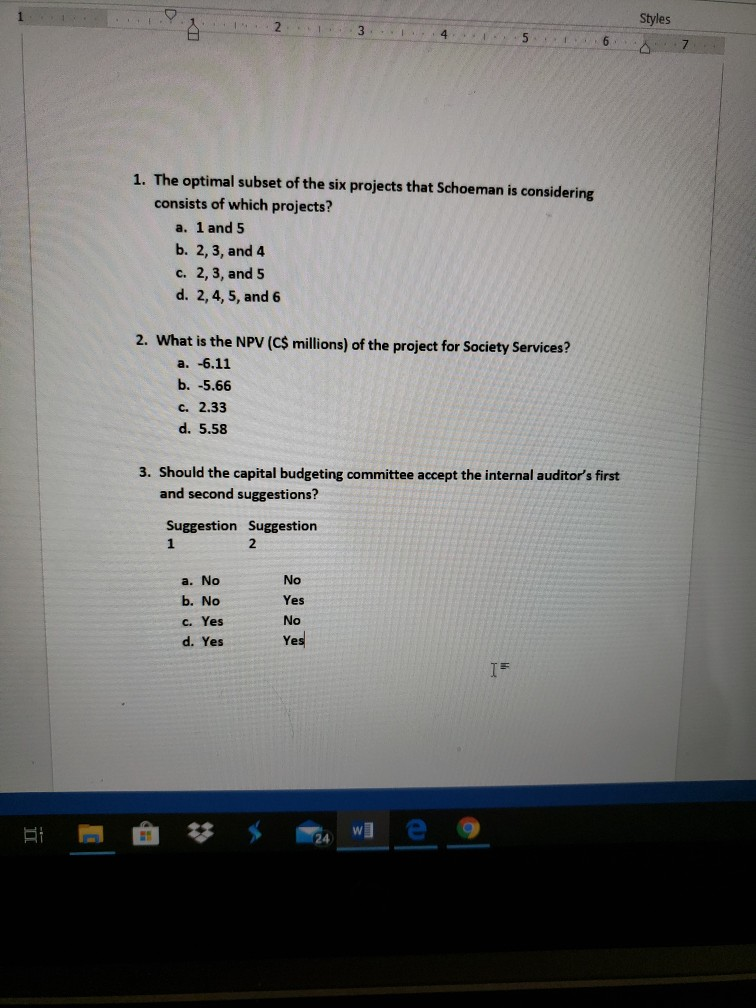

DX 1 2 3 5 6 Adapted from the book: Corporate Finance A Practical Approach by Michelle R. Clayman, Martin S., Fridson, and George H. Troughton, pages 118-120 The capital budgeting committee for Laroche Industries is meeting. Laroche is a North American conglomerate that has several divisions. Schoeman Products, a division of Laroche, has evaluated several investment projects and now must choose the subset of them that fits within its $40 million capital budget. The outlays and NPVs for the six projects follow. Schoeman cannot buy fractional projects and must buy all or none of a project. The currency amounts are in millions of Canadian dollars. Project Outlay NPV 1 2 3 4 5 6 31 15 12 10 8 6 PV of Future Cash Flows 44 21 16.5 13 11 8 13 6 4.5 3 3 2 Schoeman wants to determine which subset of the six projects is optimal. A proposal comes from the division Society Services. The cash flows relating to the project is as follows: An outlay of $190 million at time 0. Cash flows of $40 million per year for years 1-10 if demand is high. Cash flows of $20 million per year for years 1-10 if demand is low. The probability of high demand is 0.50, and the probability of low demand is 0.50. The required rate of return is 10 percent. The internal auditor for Laroche Industries has made several suggestions for improving capital budgeting processes at the company. The internal auditor's suggestions are as follows: Suggestion 1: "in order to put all capital budgeting proposals on an equal footing, the projects should all use the risk-free rate for the required rate of return." Suggestion 2: "When rationing capital, it is better to choose the portfolio of investments that maximizes the company NPV than the portfolio that maximizes the company IRR." Styles 2 3 4 5 6 1. The optimal subset of the six projects that Schoeman is considering consists of which projects? a. 1 and 5 b. 2, 3, and 4 c. 2, 3, and 5 d. 2, 4, 5, and 6 2. What is the NPV (C$ millions) of the project for Society Services? a. -6.11 b. -5.66 c. 2.33 d. 5.58 3. Should the capital budgeting committee accept the internal auditor's first and second suggestions? Suggestion Suggestion 1 2 No a. No b. No c. Yes d. Yes Yes No Yes Is BI w]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts