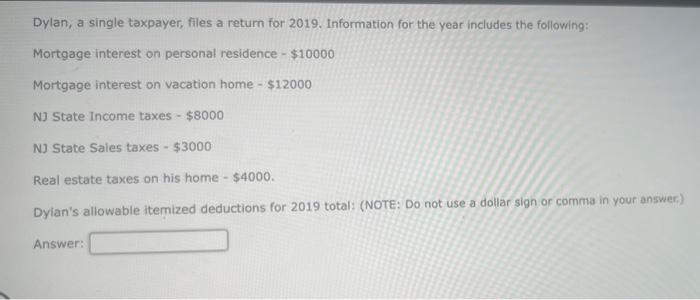

Question: Dylan, a single taxpayer, files a return for 2019 . Information for the year includes the following: Mortgage interest on personal residence $10000 Mortgage interest

Dylan, a single taxpayer, files a return for 2019 . Information for the year includes the following: Mortgage interest on personal residence $10000 Mortgage interest on vacation home - $12000 N] State Income taxes - $8000 N] State Sales taxes - $3000 Real estate taxes on his home $4000. Dylan's allowable itemized deductions for 2019 total: (NOTE: Do not use a dollar sign or comma in your answer.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts