Question: Dynamic Delta Hedging For the following values, S = 100, = .08, = 15% K = 100 Rf = 3% T = 1 Year No

Dynamic Delta Hedging

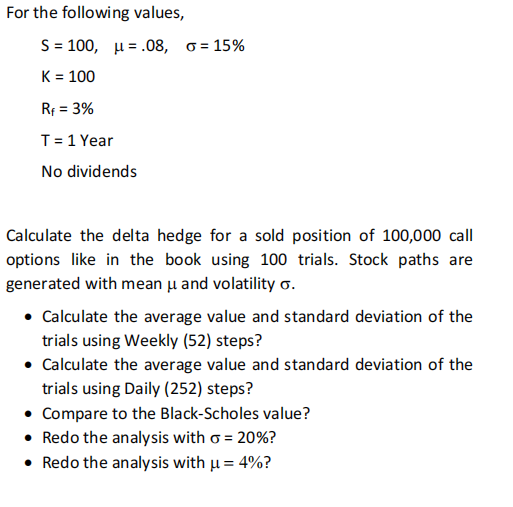

For the following values,

S = 100, = .08, = 15%

K = 100

Rf = 3%

T = 1 Year

No dividends

Calculate the delta hedge for a sold position of 100,000 call

options like in the book using 100 trials. Stock paths are

generated with mean and volatility .

Calculate the average value and standard deviation of the

trials using Weekly (52) steps?

Calculate the average value and standard deviation of the

trials using Daily (252) steps?

Compare to the Black-Scholes value?

Redo the analysis with = 20%?

Redo the analysis with ?

For the following values, S = 100, u = .08, 0 = 15% K = 100 Rp = 3% T = 1 Year No dividends Calculate the delta hedge for a sold position of 100,000 call options like in the book using 100 trials. Stock paths are generated with mean u and volatility o. Calculate the average value and standard deviation of the trials using Weekly (52) steps? Calculate the average value and standard deviation of the trials using Daily (252) steps? Compare to the Black-Scholes value? Redo the analysis with o = 20%? Redo the analysis with u = 4%? = = For the following values, S = 100, u = .08, 0 = 15% K = 100 Rp = 3% T = 1 Year No dividends Calculate the delta hedge for a sold position of 100,000 call options like in the book using 100 trials. Stock paths are generated with mean u and volatility o. Calculate the average value and standard deviation of the trials using Weekly (52) steps? Calculate the average value and standard deviation of the trials using Daily (252) steps? Compare to the Black-Scholes value? Redo the analysis with o = 20%? Redo the analysis with u = 4%? = =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts